UNCLAIMED AMOUNT OF POLICYHOLDERS IS NOT THE HIDDEN FORTUNE OF INSURERS

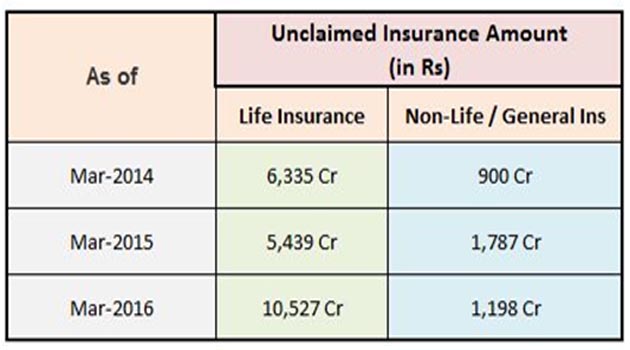

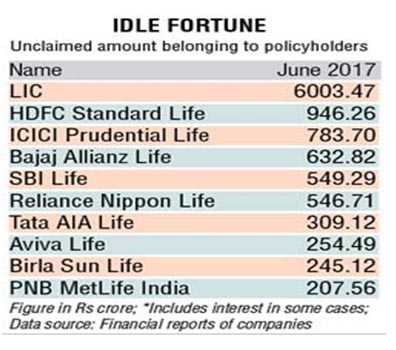

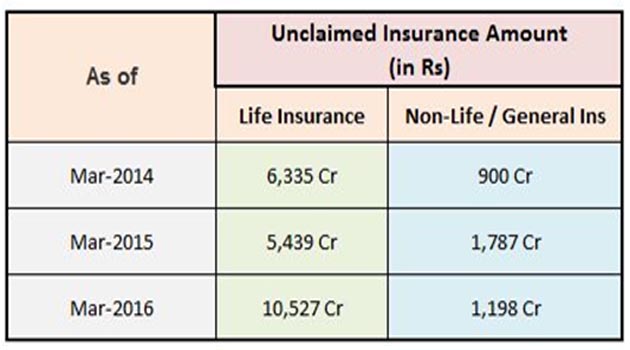

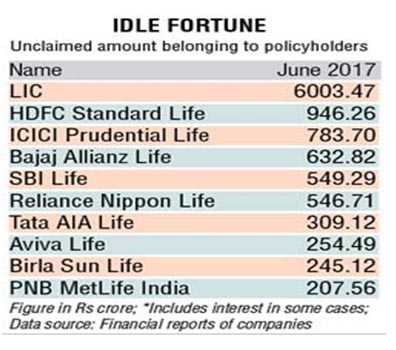

The unclaimed amount is common in insurance sector and over a period of time amounts have accumulated as unclaimed which is a cause of concern. There are the major reasons that have led to the accumulation of Rs.12,000 crore unclaimed money that is to be claimed by the rightful owner. Amongst the insurers, the highest amount of the unclaimed money has been lying with Life Insurance Corporation (LIC) – Rs.6,003.47 crores. Every financial instrument has different sets of requirement, so depending on what instrument you are facing difficulty with, you can make sure you get back your money. The digital trail has its benefits – there is a trail with the mail ID you have mentioned when investing or saving. There is also the possibility of leaving your mobile phone number as the contact, which makes it easy for institutions and regulators to contact you in future. Today, most financial instruments have linkages to your PAN or bank account, thereby reducing the probability of losing out on what is rightfully yours. In case of investments in equities and mutual funds, the demat details or folio numbers are a good start to get a handle on tracking your investments.

India is an ‘uninsured society.’ It is also an ‘un-pensioned society’ as only 11 per cent of the elderly receive pensions. This is exactly where the state should step in. Food subsidy, crop insurance and minimum support prices are some of the scheme that the government implemented to save the people from distress. The government wanted every poor person to be linked to the banking system so that they could access insurance and pension schemes. The idea of using the unclaimed funds was there in the last Finance Bill, but the scheme was not worked out. Thereafter Budget Division, Department of Economic Affairs, MOF issued Accounting procedure for transfer of the funds into the Senior Citizens’ Welfare Fund. The IRDAI issued a master circular dated 25.07.2017 advising insurers to transfer the unclaimed fund on or before 1st March 2018. Thereafter, every financial year, the process laid down in the SCWF Rules, 2016 read with accounting procedure for transfer of the funds into the Senior Citizens’ Welfare Fund shall be followed.

What is this Unclaimed Amount?’

An unclaimed amount is the money due from a life insurance company to the policyholders or their beneficiaries (nominees). This could be in the form of death or maturity claims, survival benefits, premium refunds (when a policy is cancelled) or indemnity claims – including accrued interest, etc. Any amount that has not been claimed for more than 6 months since their settlement date is considered an unclaimed amount by a life insurance company. The aadhar link to your bank account and it creeping into several financial instruments as a contact field will reduce the probability of losing out with unclaimed money from different financial products and services. But, if you have already missed out on what is rightfully due to you from the past, there are ways to recover it.

Reasons of hidden fortune:

There are chances that your investments become lost when you move house and forget to update your details with a financial institution or company. At times, the policyholders do not raise claim against their insurance money which leads to their cover remaining unclaimed with the insurers. Money paid due to maturity of policies or due to surrender of the policy and not received by the customer is considered as unclaimed insurance money. Secrecy, forgetfulness or sheer lack of knowledge can cost you and your loved ones real money. This unclaimed money could be from death or maturity claims, survival benefits and premium refunds etc. Unclaimed funds are due to change of address of the customer, instruments getting lost, incorrect bank account details, branch details undergoing a change, etc.

Disclosure of unclaimed money on website:

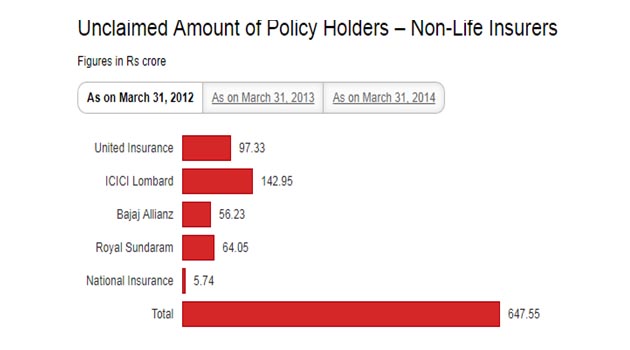

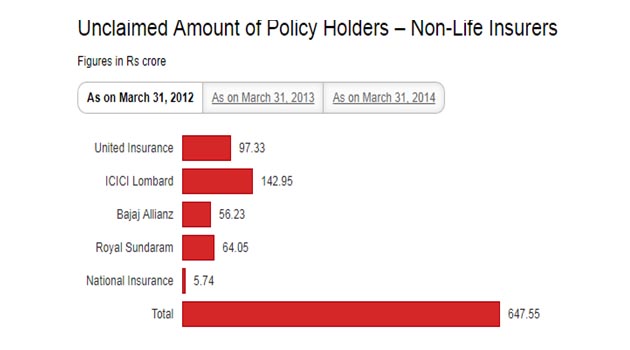

In order to ensure timely payout to policy holders, IRDAI has asked insurance companies to make various disclosures such as the amount which remained unclaimed for more than six months from the due date of settlement, nature of the unclaimed amount (death claim, maturity benefit, etc), details of action taken for payment of the unclaimed money by the insurer and the status of the unclaimed amount. The IRDAI has directed all insurance companies to post unclaimed insurance money on their respective websites, where the unclaimed sum is at least INR 1,000. The lion’s share of over INR110 billion unclaimed at 30 June was with life insurance companies. More than half of it – INR60 billion belongs to LIC, the biggest life insurer in the country. General insurance companies have a combined unclaimed balance of about INR 9 billion. Initially, insurers have been told to upload this information on their website by 31 March 2014. Subsequently, they have been advised to put up this information every six month by 30 September and 31 March every year. Among non-life insurers, United Insurance had the maximum unclaimed amount at Rs 147 crore followed by ICICI Lombard (Rs 102 crore) and Bajaj Allianz (Rs 92 crore).

What is this Unclaimed Amount?’

An unclaimed amount is the money due from a life insurance company to the policyholders or their beneficiaries (nominees). This could be in the form of death or maturity claims, survival benefits, premium refunds (when a policy is cancelled) or indemnity claims – including accrued interest, etc. Any amount that has not been claimed for more than 6 months since their settlement date is considered an unclaimed amount by a life insurance company. The aadhar link to your bank account and it creeping into several financial instruments as a contact field will reduce the probability of losing out with unclaimed money from different financial products and services. But, if you have already missed out on what is rightfully due to you from the past, there are ways to recover it.

Reasons of hidden fortune:

There are chances that your investments become lost when you move house and forget to update your details with a financial institution or company. At times, the policyholders do not raise claim against their insurance money which leads to their cover remaining unclaimed with the insurers. Money paid due to maturity of policies or due to surrender of the policy and not received by the customer is considered as unclaimed insurance money. Secrecy, forgetfulness or sheer lack of knowledge can cost you and your loved ones real money. This unclaimed money could be from death or maturity claims, survival benefits and premium refunds etc. Unclaimed funds are due to change of address of the customer, instruments getting lost, incorrect bank account details, branch details undergoing a change, etc.

Disclosure of unclaimed money on website:

In order to ensure timely payout to policy holders, IRDAI has asked insurance companies to make various disclosures such as the amount which remained unclaimed for more than six months from the due date of settlement, nature of the unclaimed amount (death claim, maturity benefit, etc), details of action taken for payment of the unclaimed money by the insurer and the status of the unclaimed amount. The IRDAI has directed all insurance companies to post unclaimed insurance money on their respective websites, where the unclaimed sum is at least INR 1,000. The lion’s share of over INR110 billion unclaimed at 30 June was with life insurance companies. More than half of it – INR60 billion belongs to LIC, the biggest life insurer in the country. General insurance companies have a combined unclaimed balance of about INR 9 billion. Initially, insurers have been told to upload this information on their website by 31 March 2014. Subsequently, they have been advised to put up this information every six month by 30 September and 31 March every year. Among non-life insurers, United Insurance had the maximum unclaimed amount at Rs 147 crore followed by ICICI Lombard (Rs 102 crore) and Bajaj Allianz (Rs 92 crore).

Senior Citizens Welfare Fund:

In India, an account is deemed unclaimed if there is no activity for at least a decade. Notably, there is an estimated Rs.64000 crore worth unclaimed accounts in banks, insurance companies, post offices, apart from inoperative provident fund accounts. Getting people to claim old accounts is one of the biggest problems encountered by these institutions. The process is not only unprofitable to the institutions, but also tedious and often comes at a cost for those who are the rightful claimants of the money. Here is what everybody ought to know about unclaimed funds. As per IRDAI circular dated July 25, 2017, any unclaimed money with an insurance company will be moved to the Indian government’s Senior Citizens Welfare Fund, if the amount has been lying unclaimed for 10 years from the date it was payable to the policyholder or the beneficiary. The government had created this fund through the Finance Acts, 2015 and 2016, to promote the welfare of senior citizens, in which notified institutions have to transfer unclaimed monies. These institutions include: postal savings scheme and Employees Provident Fund schemes. In an amendment in April this year, the government also added insurance companies to this list.

Regulatory guidelines:

All insurance companies have to disclose unclaimed amounts as a separate line in their financial statements. The companies have also been asked not to appropriate/write back the unclaimed amounts under any circumstances. In July, 2017, the insurance regulator issued a new rule directing that amounts unclaimed for more than 10 years as of 30 September 2017 will have to be deposited into a fund meant for senior citizens, the Senior Citizens’ Welfare Fund by 1 March next year. Thereafter, insurers will have to transfer such unclaimed sums every financial year to the Fund. However, policyholders and beneficiaries are eligible to claim the unpaid amounts for up to 25 years from the date of transfer of the same to the Senior Citizen’s Welfare Fund. If no claim is lodged during the 25 years, the money will belong to the government.

Senior Citizens Welfare Fund:

In India, an account is deemed unclaimed if there is no activity for at least a decade. Notably, there is an estimated Rs.64000 crore worth unclaimed accounts in banks, insurance companies, post offices, apart from inoperative provident fund accounts. Getting people to claim old accounts is one of the biggest problems encountered by these institutions. The process is not only unprofitable to the institutions, but also tedious and often comes at a cost for those who are the rightful claimants of the money. Here is what everybody ought to know about unclaimed funds. As per IRDAI circular dated July 25, 2017, any unclaimed money with an insurance company will be moved to the Indian government’s Senior Citizens Welfare Fund, if the amount has been lying unclaimed for 10 years from the date it was payable to the policyholder or the beneficiary. The government had created this fund through the Finance Acts, 2015 and 2016, to promote the welfare of senior citizens, in which notified institutions have to transfer unclaimed monies. These institutions include: postal savings scheme and Employees Provident Fund schemes. In an amendment in April this year, the government also added insurance companies to this list.

Regulatory guidelines:

All insurance companies have to disclose unclaimed amounts as a separate line in their financial statements. The companies have also been asked not to appropriate/write back the unclaimed amounts under any circumstances. In July, 2017, the insurance regulator issued a new rule directing that amounts unclaimed for more than 10 years as of 30 September 2017 will have to be deposited into a fund meant for senior citizens, the Senior Citizens’ Welfare Fund by 1 March next year. Thereafter, insurers will have to transfer such unclaimed sums every financial year to the Fund. However, policyholders and beneficiaries are eligible to claim the unpaid amounts for up to 25 years from the date of transfer of the same to the Senior Citizen’s Welfare Fund. If no claim is lodged during the 25 years, the money will belong to the government.

Things you should do to find old LIC Policy:

Tracing unclaimed funds is not an easy task since there are no centralized databases, which leaves precious little in terms of options for the insurance companies. One of these is contract services of a specialized company that engages in managing various databases and websites to try and locate the money. These services come at a cost. Notwithstanding the element of uncertainty when undertaking this exercise, the amount should be worth the expense. However, in case of insurance it is not so. Now IRDA has asked insurers to update unclaimed policy records, so you could find the LIC policy details online with keying in few basic details (Policyholder’s Name, Date of Birth etc.) online. If you don’t know the policy number, still you can check the details. Follow the following steps:

Things you should do to find old LIC Policy:

Tracing unclaimed funds is not an easy task since there are no centralized databases, which leaves precious little in terms of options for the insurance companies. One of these is contract services of a specialized company that engages in managing various databases and websites to try and locate the money. These services come at a cost. Notwithstanding the element of uncertainty when undertaking this exercise, the amount should be worth the expense. However, in case of insurance it is not so. Now IRDA has asked insurers to update unclaimed policy records, so you could find the LIC policy details online with keying in few basic details (Policyholder’s Name, Date of Birth etc.) online. If you don’t know the policy number, still you can check the details. Follow the following steps:

References:

What is this Unclaimed Amount?’

An unclaimed amount is the money due from a life insurance company to the policyholders or their beneficiaries (nominees). This could be in the form of death or maturity claims, survival benefits, premium refunds (when a policy is cancelled) or indemnity claims – including accrued interest, etc. Any amount that has not been claimed for more than 6 months since their settlement date is considered an unclaimed amount by a life insurance company. The aadhar link to your bank account and it creeping into several financial instruments as a contact field will reduce the probability of losing out with unclaimed money from different financial products and services. But, if you have already missed out on what is rightfully due to you from the past, there are ways to recover it.

Reasons of hidden fortune:

There are chances that your investments become lost when you move house and forget to update your details with a financial institution or company. At times, the policyholders do not raise claim against their insurance money which leads to their cover remaining unclaimed with the insurers. Money paid due to maturity of policies or due to surrender of the policy and not received by the customer is considered as unclaimed insurance money. Secrecy, forgetfulness or sheer lack of knowledge can cost you and your loved ones real money. This unclaimed money could be from death or maturity claims, survival benefits and premium refunds etc. Unclaimed funds are due to change of address of the customer, instruments getting lost, incorrect bank account details, branch details undergoing a change, etc.

Disclosure of unclaimed money on website:

In order to ensure timely payout to policy holders, IRDAI has asked insurance companies to make various disclosures such as the amount which remained unclaimed for more than six months from the due date of settlement, nature of the unclaimed amount (death claim, maturity benefit, etc), details of action taken for payment of the unclaimed money by the insurer and the status of the unclaimed amount. The IRDAI has directed all insurance companies to post unclaimed insurance money on their respective websites, where the unclaimed sum is at least INR 1,000. The lion’s share of over INR110 billion unclaimed at 30 June was with life insurance companies. More than half of it – INR60 billion belongs to LIC, the biggest life insurer in the country. General insurance companies have a combined unclaimed balance of about INR 9 billion. Initially, insurers have been told to upload this information on their website by 31 March 2014. Subsequently, they have been advised to put up this information every six month by 30 September and 31 March every year. Among non-life insurers, United Insurance had the maximum unclaimed amount at Rs 147 crore followed by ICICI Lombard (Rs 102 crore) and Bajaj Allianz (Rs 92 crore).

What is this Unclaimed Amount?’

An unclaimed amount is the money due from a life insurance company to the policyholders or their beneficiaries (nominees). This could be in the form of death or maturity claims, survival benefits, premium refunds (when a policy is cancelled) or indemnity claims – including accrued interest, etc. Any amount that has not been claimed for more than 6 months since their settlement date is considered an unclaimed amount by a life insurance company. The aadhar link to your bank account and it creeping into several financial instruments as a contact field will reduce the probability of losing out with unclaimed money from different financial products and services. But, if you have already missed out on what is rightfully due to you from the past, there are ways to recover it.

Reasons of hidden fortune:

There are chances that your investments become lost when you move house and forget to update your details with a financial institution or company. At times, the policyholders do not raise claim against their insurance money which leads to their cover remaining unclaimed with the insurers. Money paid due to maturity of policies or due to surrender of the policy and not received by the customer is considered as unclaimed insurance money. Secrecy, forgetfulness or sheer lack of knowledge can cost you and your loved ones real money. This unclaimed money could be from death or maturity claims, survival benefits and premium refunds etc. Unclaimed funds are due to change of address of the customer, instruments getting lost, incorrect bank account details, branch details undergoing a change, etc.

Disclosure of unclaimed money on website:

In order to ensure timely payout to policy holders, IRDAI has asked insurance companies to make various disclosures such as the amount which remained unclaimed for more than six months from the due date of settlement, nature of the unclaimed amount (death claim, maturity benefit, etc), details of action taken for payment of the unclaimed money by the insurer and the status of the unclaimed amount. The IRDAI has directed all insurance companies to post unclaimed insurance money on their respective websites, where the unclaimed sum is at least INR 1,000. The lion’s share of over INR110 billion unclaimed at 30 June was with life insurance companies. More than half of it – INR60 billion belongs to LIC, the biggest life insurer in the country. General insurance companies have a combined unclaimed balance of about INR 9 billion. Initially, insurers have been told to upload this information on their website by 31 March 2014. Subsequently, they have been advised to put up this information every six month by 30 September and 31 March every year. Among non-life insurers, United Insurance had the maximum unclaimed amount at Rs 147 crore followed by ICICI Lombard (Rs 102 crore) and Bajaj Allianz (Rs 92 crore).

Senior Citizens Welfare Fund:

In India, an account is deemed unclaimed if there is no activity for at least a decade. Notably, there is an estimated Rs.64000 crore worth unclaimed accounts in banks, insurance companies, post offices, apart from inoperative provident fund accounts. Getting people to claim old accounts is one of the biggest problems encountered by these institutions. The process is not only unprofitable to the institutions, but also tedious and often comes at a cost for those who are the rightful claimants of the money. Here is what everybody ought to know about unclaimed funds. As per IRDAI circular dated July 25, 2017, any unclaimed money with an insurance company will be moved to the Indian government’s Senior Citizens Welfare Fund, if the amount has been lying unclaimed for 10 years from the date it was payable to the policyholder or the beneficiary. The government had created this fund through the Finance Acts, 2015 and 2016, to promote the welfare of senior citizens, in which notified institutions have to transfer unclaimed monies. These institutions include: postal savings scheme and Employees Provident Fund schemes. In an amendment in April this year, the government also added insurance companies to this list.

Regulatory guidelines:

All insurance companies have to disclose unclaimed amounts as a separate line in their financial statements. The companies have also been asked not to appropriate/write back the unclaimed amounts under any circumstances. In July, 2017, the insurance regulator issued a new rule directing that amounts unclaimed for more than 10 years as of 30 September 2017 will have to be deposited into a fund meant for senior citizens, the Senior Citizens’ Welfare Fund by 1 March next year. Thereafter, insurers will have to transfer such unclaimed sums every financial year to the Fund. However, policyholders and beneficiaries are eligible to claim the unpaid amounts for up to 25 years from the date of transfer of the same to the Senior Citizen’s Welfare Fund. If no claim is lodged during the 25 years, the money will belong to the government.

Senior Citizens Welfare Fund:

In India, an account is deemed unclaimed if there is no activity for at least a decade. Notably, there is an estimated Rs.64000 crore worth unclaimed accounts in banks, insurance companies, post offices, apart from inoperative provident fund accounts. Getting people to claim old accounts is one of the biggest problems encountered by these institutions. The process is not only unprofitable to the institutions, but also tedious and often comes at a cost for those who are the rightful claimants of the money. Here is what everybody ought to know about unclaimed funds. As per IRDAI circular dated July 25, 2017, any unclaimed money with an insurance company will be moved to the Indian government’s Senior Citizens Welfare Fund, if the amount has been lying unclaimed for 10 years from the date it was payable to the policyholder or the beneficiary. The government had created this fund through the Finance Acts, 2015 and 2016, to promote the welfare of senior citizens, in which notified institutions have to transfer unclaimed monies. These institutions include: postal savings scheme and Employees Provident Fund schemes. In an amendment in April this year, the government also added insurance companies to this list.

Regulatory guidelines:

All insurance companies have to disclose unclaimed amounts as a separate line in their financial statements. The companies have also been asked not to appropriate/write back the unclaimed amounts under any circumstances. In July, 2017, the insurance regulator issued a new rule directing that amounts unclaimed for more than 10 years as of 30 September 2017 will have to be deposited into a fund meant for senior citizens, the Senior Citizens’ Welfare Fund by 1 March next year. Thereafter, insurers will have to transfer such unclaimed sums every financial year to the Fund. However, policyholders and beneficiaries are eligible to claim the unpaid amounts for up to 25 years from the date of transfer of the same to the Senior Citizen’s Welfare Fund. If no claim is lodged during the 25 years, the money will belong to the government.

Things you should do to find old LIC Policy:

Tracing unclaimed funds is not an easy task since there are no centralized databases, which leaves precious little in terms of options for the insurance companies. One of these is contract services of a specialized company that engages in managing various databases and websites to try and locate the money. These services come at a cost. Notwithstanding the element of uncertainty when undertaking this exercise, the amount should be worth the expense. However, in case of insurance it is not so. Now IRDA has asked insurers to update unclaimed policy records, so you could find the LIC policy details online with keying in few basic details (Policyholder’s Name, Date of Birth etc.) online. If you don’t know the policy number, still you can check the details. Follow the following steps:

Things you should do to find old LIC Policy:

Tracing unclaimed funds is not an easy task since there are no centralized databases, which leaves precious little in terms of options for the insurance companies. One of these is contract services of a specialized company that engages in managing various databases and websites to try and locate the money. These services come at a cost. Notwithstanding the element of uncertainty when undertaking this exercise, the amount should be worth the expense. However, in case of insurance it is not so. Now IRDA has asked insurers to update unclaimed policy records, so you could find the LIC policy details online with keying in few basic details (Policyholder’s Name, Date of Birth etc.) online. If you don’t know the policy number, still you can check the details. Follow the following steps:

- Remember that an insurance policy bought many years ago may not have been in your current married name (old sir name/family name for married women).

- Life insurance policy bought by parents/grandparents on your behalf may be jointly in their names and, where relevant, they may also be in your maiden name.

- Check the LIC India premium debited entry in the old saving account passbook.

- A change of address is one of the most common reasons people lose track of their policies over the years. So check old address for past letters or LIC Receipt etc.

- Even if the policy is many years old it could be in the above LIC database.

- Insurers allow you to spot your unclaimed money on their websites. You simply need to look under the tab titled ‘unclaimed amount of policyholders’.

- On the page that opens, once you click the tab, you need to enter the following details: name of the policyholder, policy number, Permanent Account Number (PAN), Aadhaar number and date of birth. Upon filling these details you can come to know the details of any unclaimed amount.

- The policyholder’s name and date of birth are compulsory, whereas PAN and policy number could be optional.

References:

- http://www.indiaspend.com/special-reports/insurance-firms-sit-on-rs-6700-crore

- http://www.livemint.com/Money/O1ZLFg5sralCwUSKUsf7bO/New-rules-about-unclaimed-insurance-money

- https://www.licindia.in/Bottom-Links/Unclaimed-Policy-Dues

- https://economictimes.indiatimes.com/wealth/personal-finance-news/insurance-companies

- http://www.dnaindia.com/business/report-unclaimed-insurance-pot-grows

- http://www.financialexpress.com/money/how-to-track-unclaimed-life-insurance-money-

- Newspapers & Journals.

About the Author

JAGENDRA KUMAR Ex. CEO, Pearl Insurance Brokers 71/143, “Ramashram” Paramhans Marg, Mansarovar, JAIPUR-302020

Leave a Reply