SHIELDING PROFESSIONALS FROM CLAIMS MADE AGAINST THEM BY THEIR CLIENTELE

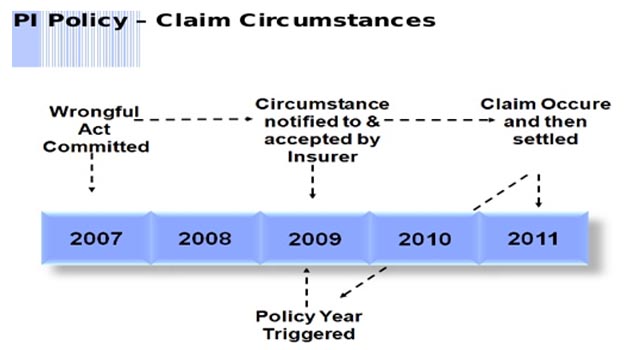

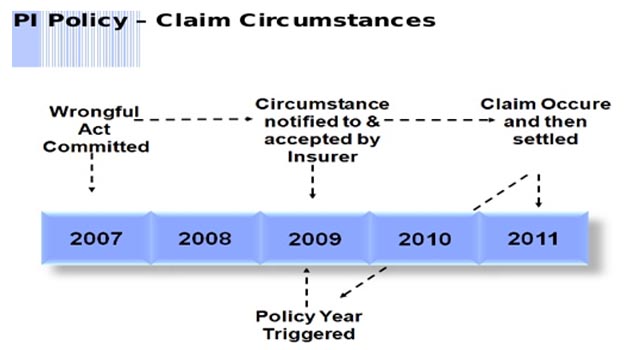

There has been a rise in consumer awareness. Courts are more consumer-friendly now and patients have sued hospitals and doctors malpractice or negligence and the courts have been asking doctors and hospitals to pay for their mistakes. If a professional is alleged to have provided inadequate advice, services or designs to a client, professional indemnity insurance provides cover for the legal costs and expenses in defending the claim, as well as compensation payable to their client to rectify the mistake. Professional liability insurance (PLI), also called professional indemnity insurance (PII) but more commonly known in the US as errors & omissions (E&O), is a form of liability insurance which helps protect professional advice- and service-providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client, and damages awarded in such a civil lawsuit. The coverage focuses on alleged failure to perform on the part of, financial loss caused by, and error or omission in the service or product sold by the policyholder. These are causes for legal action that would not be covered by a more general liability insurance policy which addresses more direct forms of harm. Professional liability insurance may take on different forms and names depending on the profession, especially medical and legal, and is sometimes required under contract by other businesses that are the beneficiaries of the advice or service. Professional liability insurance policies are generally set up based on a claims-made basis, meaning that the policy only covers claims made during the policy period. More specifically a typical policy will provide indemnity to the insured against loss arising from any claim or claims made during the policy period by reason of any covered error, omission or negligent act committed in the conduct of the insured’s professional business during the policy period. Claims which may relate to incidents occurring before the coverage may also be covered, means claims made during the policy period but which relate to an incident after the retroactive date.

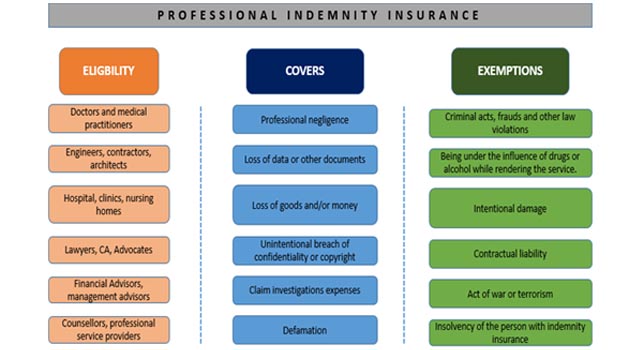

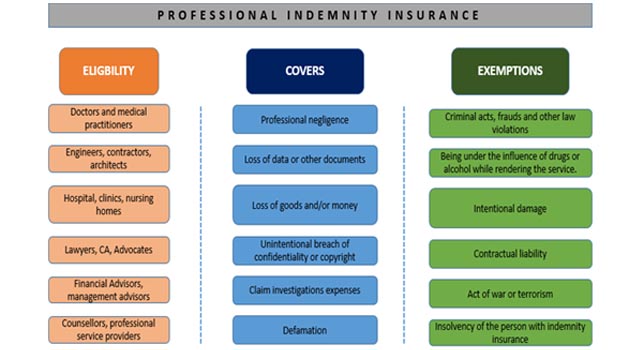

Some professions entail a risk which can lead to a big liability if something goes wrong. This is where a professional indemnity cover can help. People act on recommendations of professionals. Hence, if a professional makes a mistake, the person he has advised will be impacted. The public is more aware of their rights and the duties of professionals and know that they will be heard in the court of law if they are wronged. The judicial system is also more empathic to the consumer. This definitely improves the accountability of professionals. Professional indemnity cover takes care of the financial liability claim raised by the consumer. The professonals should take care that the sum assured is not very small. It should be renewed regularly and that one is covered both at the time of the event and when the claim is made and is to be paid. If one plans to change the insurer, then events of the past should be taken into consideration. The cover is not limited to consultancy. It includes educational institutes, art valuers, auctioneers, tour operators and staffing companies as well. Even chartered accountants, company secretaries, public relations professionals, management consultants and insurance brokers can buy this policy. More and more professions are coming under this ambit because newer jobs are getting created which are consultancies based. Also, due to increasing education, awareness levels, and huge sums spent by individuals in getting these services, they have started questioning these professionals if the services are found faulty, incorrect and not up to the mark. On the back of this, the policies sold under this segment have seen a good 40 to 45 per cent jump. Since clients act on the advice and recommendations of such professionals, the latter always face a risk of getting sued. The cover will pay legal cost to compensate the client, as decided by a court.

Usually the professional indemnity insurance provides cover to the extent of financial damage for loss caused to victim which is not a result of wilful neglect. This is due to unintentional errors and omissions by professionals and insured partners. The scope of cover, however, varies with each profession. For instance, registered medical practitioners such as physicians, surgeons, cardiologists and pathologists as well as medical establishments are protected against legal liability claims made by any of their patients that may be based on bodily injuries and/or death. The policy also pays for the defence cost incurred in defending the case. And they can insure not only themselves, but also other partner or consulting doctors as well as employed assistants. Professions like accountancy, law and medical are considered the riskiest. This is because clients are aware of the increasing fraudulent practices that take place in these professions. The premiums are the most expensive here, usually, more than one per cent of the sum insured. For instance, to cover a doctor for Rs 50 lakh, he would have to shell out Rs 50,000 as premium. For less riskier professions, the premium rate could vary in the range of 0.30 to one per cent of the sum insured.

Usually the professional indemnity insurance provides cover to the extent of financial damage for loss caused to victim which is not a result of wilful neglect. This is due to unintentional errors and omissions by professionals and insured partners. The scope of cover, however, varies with each profession. For instance, registered medical practitioners such as physicians, surgeons, cardiologists and pathologists as well as medical establishments are protected against legal liability claims made by any of their patients that may be based on bodily injuries and/or death. The policy also pays for the defence cost incurred in defending the case. And they can insure not only themselves, but also other partner or consulting doctors as well as employed assistants. Professions like accountancy, law and medical are considered the riskiest. This is because clients are aware of the increasing fraudulent practices that take place in these professions. The premiums are the most expensive here, usually, more than one per cent of the sum insured. For instance, to cover a doctor for Rs 50 lakh, he would have to shell out Rs 50,000 as premium. For less riskier professions, the premium rate could vary in the range of 0.30 to one per cent of the sum insured.

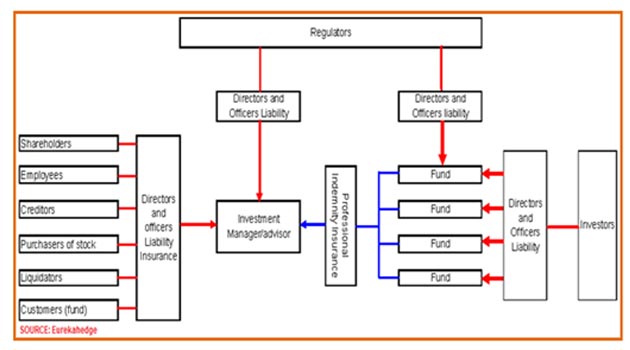

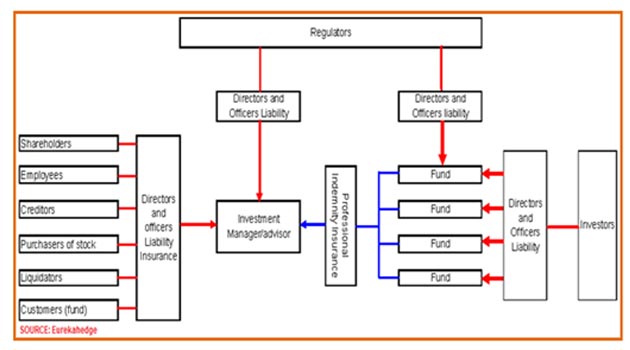

Professional indemnity insurance is a type of insurance policy which is designed to shield professionals and business owners if they are found to be guilty of some event such as misjudgement or some other professional risks. Indemnity insurance is also called as professional liability insurance. It provides cover for the claim of providing inadequate services, advice, design, etc. against the insured. Liability insurance also covers the compensation that is payable to the client for correcting the mistake. The term “insurance,” broadly speaking, refers to steps taken to acquire some protection against any kind of real or perceived actions or consequences. In the context of professional liability insurance, such protection is sought against possible consequences arising out of one’s professional conduct. As illustrated in the diagram below (representing a hedge fund management company), professionals constantly face liability threats during the course of their work and from multiple sources. The red lines illustrate the exposure that officers and directors of a firm face from claims arising out of a possible breach of duty:

Professional indemnity insurance is a type of insurance policy which is designed to shield professionals and business owners if they are found to be guilty of some event such as misjudgement or some other professional risks. Indemnity insurance is also called as professional liability insurance. It provides cover for the claim of providing inadequate services, advice, design, etc. against the insured. Liability insurance also covers the compensation that is payable to the client for correcting the mistake. The term “insurance,” broadly speaking, refers to steps taken to acquire some protection against any kind of real or perceived actions or consequences. In the context of professional liability insurance, such protection is sought against possible consequences arising out of one’s professional conduct. As illustrated in the diagram below (representing a hedge fund management company), professionals constantly face liability threats during the course of their work and from multiple sources. The red lines illustrate the exposure that officers and directors of a firm face from claims arising out of a possible breach of duty:

Bibliography:

WHAT IS PROFESSIONAL INDEMNITY COVER?

This policy is meant for professionals to cover liability falling on them as a result of errors and omissions committed by them whilst rendering professional service. The policy offers a benefit of Retroactive period on continuous renewal of policy whereby claims reported in subsequent renewal but pertaining to earlier period after first inception of the policy, also become payable. Group policies can also be issued covering members of one profession. Group discount in premium is available depending upon the number of members covered. The policy covers all sums which the insured professional becomes legally liable to pay as damages to third party in respect of any error and/or omission on his/her part committed whilst rendering professional service. Legal cost and expenses incurred in defence of the case, with the prior consent of the insurance company, are also payable, subject to the overall limit of indemnity selected. Only civil liability claims are covered. Any liability arising out of any criminal act or act committed in violation of any law or ordinance is not covered. In professional liability covers, the sum insured is known as the ‘limit of liability. A sum insured is quantifiable. If a building is worth Rs 100 crore, it needs a cover for a similar amount. But in professional indemnity, the claim amount is unknown. So, insurers set a limit to liability, that is, the extent to which they will bear the loss; the balance will have to be borne by the professional. The basic rate for a professional indemnity policy ranges from 0.30% to 1% of the amount insured. Various professionals can avail of this policy. The premium depends on factors such as profession, experience, income, limits, jurisdiction and claim experience. It does not cover professionals from the financial services industry.WHO CAN TAKE THE POLICY?

The cover, in fact, is needed as the insured may not be able to bear the loss if a claim is brought against him/his company, as also to comply with contractual obligations and sometimes with statutory mandates. For individual professionals, having this policy can ensure their personal as well as professional survival should they have to pay a claim. The policy is meant for following group of professionals:-- Doctors and medical practitioners – It covers registered medical practitioners like physicians, surgeons, cardiologists, pathologists etc.

- Medical establishments – It covers legal liability falling on the medical establishment such as hospitals and nursing homes, as a result of error or omission committed by any named professional or qualified assistants engaged by the medical establishment.

- Engineers, architects and interior decorators.

- Lawyers, advocates, solicitors and counsels.

- Chartered accountants, financial accountants, management consultants.

WHAT IS COVERED UNDER THE PI POLICY?

Broadly speaking, professional indemnity insurance indemnifies the insured against financial loss resulting from a claim brought about due to an error or omission committed while performing a service contracted for. One condition, however, being that the loss must be to a third party who has suffered bodily injury or property damage. The policy indemnifies against compensation claims arising out of breach of duty by a negligent act, error or omission while discharging professional duty. The defence costs can also be covered. Professionals like architects, engineers, doctors, lawyers, chartered accountants, and medical practitioners, and services such as medical establishments need to protect their business interests against legal claims for error, omissions, professional neglect for both the principles and their employees. The Professional Indemnity Insurance Policy comprehensively covers them for all legally established claims arising from the covered perils like:- Legal liability due to bodily injury or death caused by breach of professional duty by the insured

- The predecessors in business of the said firm, if covered

- Any person at any time employed by the Insured or by such predecessors in business in the conduct, by or on behalf of the said firm or such predecessors of any business conducted in their professional capacity

- Payment of defence costs, fees and expenses in accordance with Indian Law

Usually the professional indemnity insurance provides cover to the extent of financial damage for loss caused to victim which is not a result of wilful neglect. This is due to unintentional errors and omissions by professionals and insured partners. The scope of cover, however, varies with each profession. For instance, registered medical practitioners such as physicians, surgeons, cardiologists and pathologists as well as medical establishments are protected against legal liability claims made by any of their patients that may be based on bodily injuries and/or death. The policy also pays for the defence cost incurred in defending the case. And they can insure not only themselves, but also other partner or consulting doctors as well as employed assistants. Professions like accountancy, law and medical are considered the riskiest. This is because clients are aware of the increasing fraudulent practices that take place in these professions. The premiums are the most expensive here, usually, more than one per cent of the sum insured. For instance, to cover a doctor for Rs 50 lakh, he would have to shell out Rs 50,000 as premium. For less riskier professions, the premium rate could vary in the range of 0.30 to one per cent of the sum insured.

Usually the professional indemnity insurance provides cover to the extent of financial damage for loss caused to victim which is not a result of wilful neglect. This is due to unintentional errors and omissions by professionals and insured partners. The scope of cover, however, varies with each profession. For instance, registered medical practitioners such as physicians, surgeons, cardiologists and pathologists as well as medical establishments are protected against legal liability claims made by any of their patients that may be based on bodily injuries and/or death. The policy also pays for the defence cost incurred in defending the case. And they can insure not only themselves, but also other partner or consulting doctors as well as employed assistants. Professions like accountancy, law and medical are considered the riskiest. This is because clients are aware of the increasing fraudulent practices that take place in these professions. The premiums are the most expensive here, usually, more than one per cent of the sum insured. For instance, to cover a doctor for Rs 50 lakh, he would have to shell out Rs 50,000 as premium. For less riskier professions, the premium rate could vary in the range of 0.30 to one per cent of the sum insured.

HOW TO SELECT THE SUM INSURED?

In Professional Indemnity Policy, the sum insured is referred to as Limit of Indemnity. This limit is fixed per accident and per policy period which is called Any One Accident (AOA) limit and Any One Year (AOY) limit respectively. The ratio of AOA limit to AOY limit can be chosen from the following:- 1:1

- 1:2

- 1:3

- 1:4

HOW LOSSES ARE INDEMNIFIED?

The term “liability” means responsibility and “legal liability” means responsibilities which can be enforced by law. Legal Liability may be classified into Criminal Liability and Civil Liability. Only Civil Liability claims are payable. Civil Liability claims will arise if there is prima facie evidence of negligence by the insured resulting in injury or death to any third party or resulting in damage to property belonging to a person other than insured. Negligence will be proved only when following conditions are satisfied:- Existence of duty of care

- Breach of this duty

- Injury suffered by a person or property damaged as a result of that breach.

Professional indemnity insurance is a type of insurance policy which is designed to shield professionals and business owners if they are found to be guilty of some event such as misjudgement or some other professional risks. Indemnity insurance is also called as professional liability insurance. It provides cover for the claim of providing inadequate services, advice, design, etc. against the insured. Liability insurance also covers the compensation that is payable to the client for correcting the mistake. The term “insurance,” broadly speaking, refers to steps taken to acquire some protection against any kind of real or perceived actions or consequences. In the context of professional liability insurance, such protection is sought against possible consequences arising out of one’s professional conduct. As illustrated in the diagram below (representing a hedge fund management company), professionals constantly face liability threats during the course of their work and from multiple sources. The red lines illustrate the exposure that officers and directors of a firm face from claims arising out of a possible breach of duty:

Professional indemnity insurance is a type of insurance policy which is designed to shield professionals and business owners if they are found to be guilty of some event such as misjudgement or some other professional risks. Indemnity insurance is also called as professional liability insurance. It provides cover for the claim of providing inadequate services, advice, design, etc. against the insured. Liability insurance also covers the compensation that is payable to the client for correcting the mistake. The term “insurance,” broadly speaking, refers to steps taken to acquire some protection against any kind of real or perceived actions or consequences. In the context of professional liability insurance, such protection is sought against possible consequences arising out of one’s professional conduct. As illustrated in the diagram below (representing a hedge fund management company), professionals constantly face liability threats during the course of their work and from multiple sources. The red lines illustrate the exposure that officers and directors of a firm face from claims arising out of a possible breach of duty:

WHAT PI POLICY DOES NOT COVER?

While the policy covers a wide range of risks related to a profession, it has some limitations. Every profession, and every professional within that organisation, will be profiled differently based on the job profile’s risk. Professional Indemnity insurance is a kind of insurance that is mainly designed to shelter professionals from claims made against them by clients. This makes perfect business sense to an Architect, Engineer, Doctor, Lawyer, Chartered Accountant, Medical Practitioner, Mortgage Intermediary, Insurance Broker or a Financial Adviser. Also a service industry like a medical establishment would require this cover to protect the business interests against legal claims for error, omissions, professional neglect for both the principles and their employees. Scores of Consultants, Advertising and PR agencies and Designers also choose to go in for this type of insurance. The policy does not cover any claim made against them in respect of:- Any criminal act or any act committed in violation of any law or ordinance

- Services rendered while under the influence of intoxicants or narcotics

- Any third party public liability

- Any condition caused by or associated with AIDS

- Rising out of all personal injuries such as libel, slander, false arrest, wrongful eviction, wrongful detention, defamation, etc. and resultant mental injury, anguish or shock

- Infringement of plans, copy-right, patent, trade name, trade mark, registered design

- Assumed by the insured by agreement and which would not have attached in the absence of such agreement.

- Deliberate, wilful or intentional noncompliance of any statutory provision.

- Non-compliance with technical standards commonly observed in professional practice, laid down by law, or regulated by official bodies

- Loss of pure financial nature such as loss of goodwill or loss of market

- Any dishonest, fraudulent criminal or malicious act or omission

- Fines, penalties, punitive or exemplary damages.

- Professional services rendered by the Insured prior to the Retroactive Date in the Schedule.

- Deliberate conscious or intentional disregard of the insured’s technical or administrative management of the need to take all reasonable steps to prevent claims.

- Injury to any person under the contract of employment or apprenticeship with the insured their contractor(s) and/or Sub-Contractor(s) when such injury arises out of the execution of such contract.

- War and nuclear perils

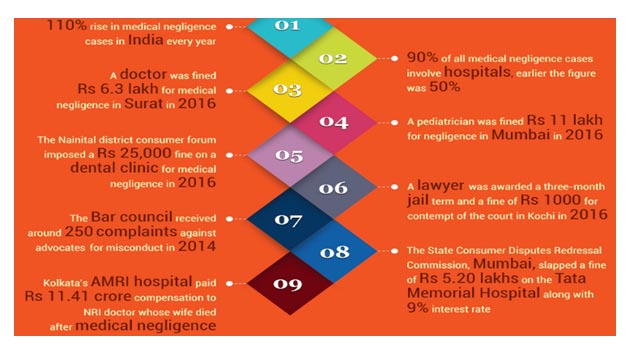

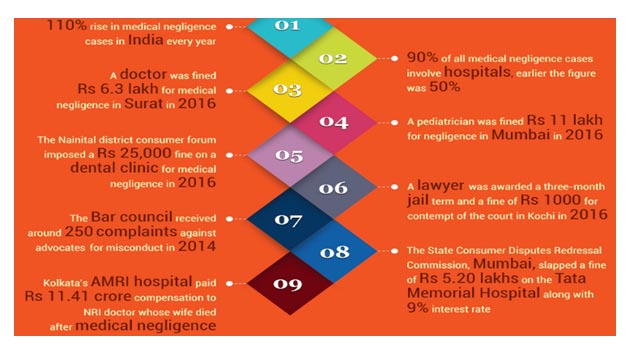

IS PI POLICY MANDATORY?

In respect of industry bodies’ regulatory requirements, many business sectors require PI insurance – accountancy, engineering and surveying to name but a few. Professionals working on a contract basis – such as management consultants, business consultants and IT contractors will almost certainly need PI insurance in order to be awarded a contract. However, they are not legally obliged to have PI insurance. In the absence of PI Policy they could have to pay lacs of rupees in compensation and legal fees to defend a claim. This would be in addition to the opportunity cost of time spent defending the allegations. No matter how large or small a business, without PI cover their financial position could be left vulnerable if a claim is brought against them. Although most professionals strive to provide the best service possible, people do make mistakes; knowing that adequate insurance is in place will give peace of mind that their organisation is covered. Earlier people didn’t question ‘professional’ services because the common man lacked education and was heavily dependent on the provider. The situation has changed considerably. Since people spend huge sums on getting these services, compromising on its quality is out of question. Hence, take the legal route in case services are found to be faulty, not up to the mark, or of lower standards. Professionals are employed with complete trust and faith by clients. Unfortunately, human error cannot be eliminated and hence they are exposed to the risk of claims from clients who have suffered loss due to neglect, error or omission. In today’s litigious world, claims can pose a significant threat to the financial security for a medical practitioner. The Professional indemnity insurance policy is meant for professionals to cover liability falling on them as a result of errors and omissions committed by them whilst rendering professional service or for settlements negotiated in accordance with the coverage afforded by the policy. Professional indemnity helps protect professional advice- and service-providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client. Some Professional indemnity policies go further than the standard cover and provide indemnity ‘for any civil liability’. This covers such areas as breach of contract, libel and slander. Some standard cover policies may also include libel and slander as extensions to the policy wordings if required. This kind of instances is common across the country now:

NO COVER FOR INSOLVENCY PROFESSIONALS:

According to the Institute of Company Secretaries of India, over 100,000 cases (many of them pending with Debt Recovery Tribunals now) will be tried under IBC, leading to a spurt in the number of insolvency practitioners as well. Insurance companies do not cover insolvency professionals and modalities are being worked out for at least 15 deals that are close to being finalized Currently, there are at least 100 cases being tried and the Reserve Bank of India (RBI) has identified 500 large stressed accounts in total that could go under IBC if banks fail to finalize a resolution plan within six months. The need for an indemnity cover becomes essential as the insolvency professional can be held responsible for mismanaging the company. In one case—that of Starlog Enterprise Ltd which was referred to the National Company Law Tribunal by ICICI Bank Ltd—the company successfully argued at the appellate tribunal that the insolvency resolution process (IRP) violated the code and some of its action resulted in loss of business from longstanding clients. But insurance brokers such as Marsh India, which is currently working with several insurers to design an indemnity cover, believe insurers are themselves hesitant to provide a cover for insolvency professionals—since these are individual, whereas a different set of data points are needed to assess risk. In the absence of a specific product, the industry has two options. One is to incorporate an insolvency practitioner’s liability as part of existing plans. The other is to create a new product, which is a time-consuming affair. If an insurer needs to create a product, they need to get support of reinsurers and run the product through the regulator and get the product approved. Insolvency professionals are taking sufficient precautions to ensure that potential damages are avoided. Currently, there is no personal indemnity cover for Insolvency Professionals unless it is Entity, or IPE, then that IPE will be covered under professional indemnity. The biggest hitch is not with the product or risk, but since rules in India expect individuals and not professional services firms to do this work, it’s difficult to estimate what kind of claims are going to come, where the claims are going to come from and what is quantum of claims. Another sticking point is the low amount of so-called deductibles that are currently being proposed. Deductibles refer to the threshold limit only beyond which insurance would kick in. In other words, it’s the skin in the game for the insured. Globally these policies carry meaningful levels of deductibles, but in India since insolvency practitioners are individually exposed; large deductibles may not be acceptable. That, in turn, makes it unattractive for insurance companies to provide this cover. In any case, according to a 2014 Federation of Indian Chambers of Commerce and Industry (FICCI) report, indemnity cover penetration in India is 0.04% of gross domestic product against 1.25% globally. There are special covers for celebrities too. Some cricketers in India also opt for a personal accident cover, which is a temporary disability cover. With multi-year endorsements, the loss of income worth crores a year can be a big blow to them. When we talk about insuring someone’s legs, feet or hands, we are covering accidents resulting in the inability to use these and the resultant financial loss. As long as one can calculate the financial impact of a potential loss, one can insure any body part. Despite a clear need, covers for celebrities, models, sports persons and artistes have not taken off in India. Such insurance covers are offered selectively and the sum insured depends on annual revenue popularity, age, etc. If the sum to be insured is high, insurance companies often seek reinsurance. Right now professionals like sportsmen can buy a personal accident or a critical illness policy for loss of income due to an unforeseen event. But in professional indemnity, the claim amount is unknown. So, insurers set a limit to liability, that is, the extent to which they will bear the loss; the balance will have to be borne by the professional. The policy pay the sum assured that has been set as a limit as the extent of damage cannot be quantified. The expense over and above the sum assured has to be borne by the doctor. Usually, there is no fixed limit on the indemnity. The cover that one takes depends on factors such as risk, probability of occurrence of events that can make one liable. Here the sum insured is referred to as Limit of Indemnity. This limit is fixed per accident and per policy period i.e. AOA & AOY respectively. Professional Indemnity/ Errors and Omissions Insurance cover provides protection for the company and its subsidiaries for claims brought in respect of negligent acts, errors or omissions in the performance of professional services. The policy is meant to pay for defence expenses and damages and includes amounts that the insured is legally required to pay because of judgments, arbitration awards or the like rendered against the insured, or for settlements negotiated in accordance with the coverage afforded by the policy. In fact, in today’s world, any professional – be that a doctor, lawyer, CA or architect — or professional bodies such as medical establishments, BPOs, law firms, IT companies or financial institutions, who render skilful advice and services to people, can be sued for negligence, errors and omissions on their part, the cost of which, in some cases, can be exorbitant. The one saving grace is that the extent of damage can be reduced if someone has already opted for professional indemnity insurance, and any loss or damage caused to the victim is not the result of any deliberate act or wilful neglect. Some professions entail a risk which can lead to a big liability if something goes wrong. This is where a professional indemnity cover can help.Author

JAGENDRA KUMAR Ex. CEO, Pearl Insurance Brokers

Bibliography:

- FICCI report -2015

- http://www.tflguide.com/2016/07/professional-indemnity-insurance-doctors

- https://securenow.in/blog/how-a-professional-indemnity-insurance-is-boon

- https://www.fincash.com/b/insurance/indemnity-insurance

- http://www.advisoryhq.com/articles/overview-of-10-professional-liability-insurance

- http://economictimes.indiatimes.com/wealth/insure/cover-your-professional-risks

- http://www.business-standard.com/article/pf/cover-for-professional-mistakes

- IRDAI Annual Report 2015-16

- Newspapers & Journals

Leave a Reply