Online user experience poor with Indian life insurers

The years of efforts by the India’s insurance regulator IRDA to ensure insurance companies make their insurance products easily understood by customers doesn’t seem to have yielded the desired results.

A first-ever syndicated user experience research involving 33 life insurance companies, general insurance companies and banks that sell insurance products online showed that over 85% of websites either don’t recommend any policy or recommend wrong policies to customers.

Only 15% of websites offered life insurance policies that customers wanted, says the yet-to-be released report by Kern Communications, the Indian user experience consultancy firm that counts Google, Nokia, Blackberry, Samsung, Sony, Lufthansa and Standard Chartered among its clients.

While the benchmark for excellent user experience is above 75 marks and good experience is above 60 marks, Max New York emerged as the topper among 33 entities with 53.36 marks. ICICI Prudential was a close second at 48.62, followed by Bajaj Allianz at 47.83 and Kotak Life at 44.1 marks.

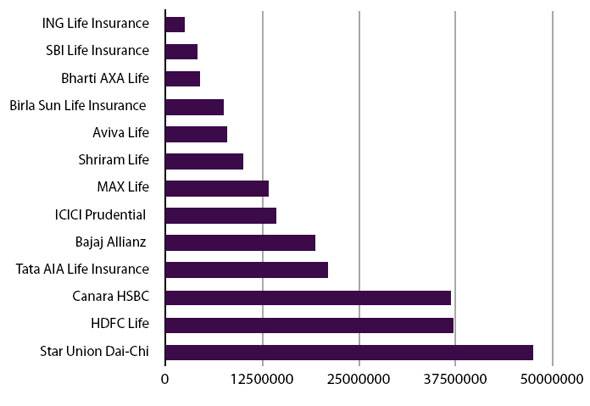

In Pic: There is a huge variation in the recommended cover based on similar inputs across the websites. It varies from Rs 24 Lakh to Rs 4.64 Crores.

In Pic: There is a huge variation in the recommended cover based on similar inputs across the websites. It varies from Rs 24 Lakh to Rs 4.64 Crores.

The user experience research, where Kern used its proprietary usability methodology called Katerpiller, showed that human value calculations across websites selling life insurance had extremely high variations with same inputs – the variation ranging from a low of Rs 24 lakh to a high of Rs 4.64 crore.

Most online insurance websites provided minimal details about the policy, mostly hidden in a PDF brochure, making it very difficult for the customers to find details. The customers had to spend time to search for information, which was distributed throughout the website, in the absence of any reasonable user flow. The research also found that almost all the insurance companies and banks selling life insurance products used internal terms and industry jargon throughout their websites, making it tough for the users to understand the information.

Kern chief executive Ripul Kumar admits the websites selling insurance needs to be information heavy but they need to be organized in a way that users can find information easily.

http://economictimes.indiatimes.com/personal-finance/insurance/insurance-news/online-user-experience-poor-with-indian-life-insurers-says-kern-report/articleshow/18560238.cms

Leave a Reply