Motor insurance in Asia-Pacific to reach $294.2bn in 2025, forecasts GlobalData

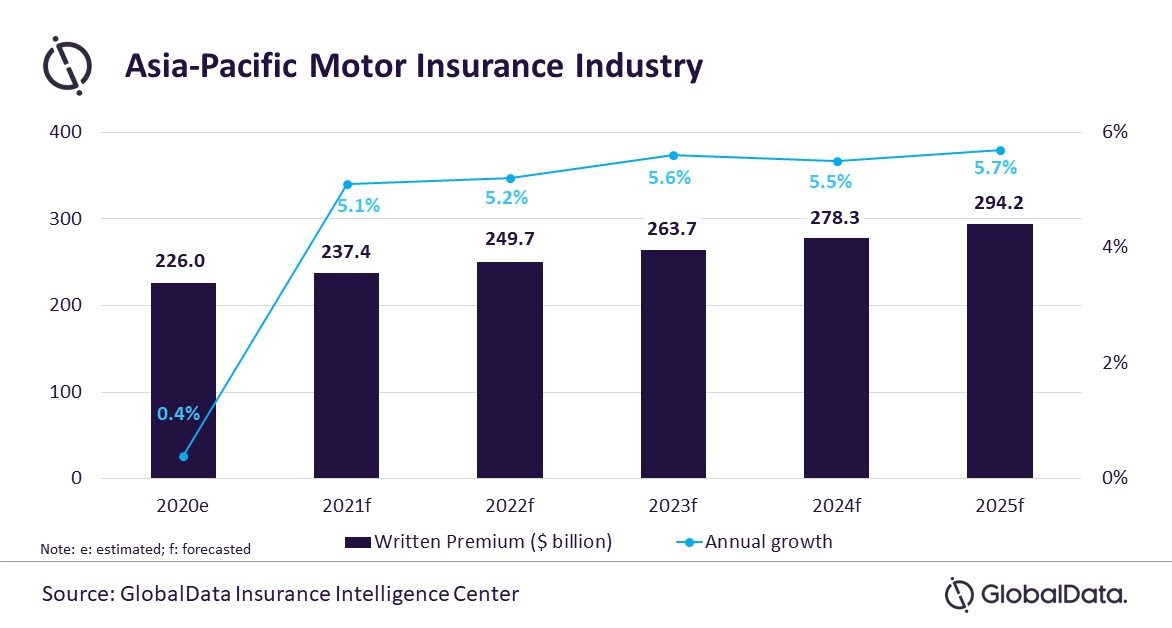

The motor insurance industry in Asia-Pacific (APAC) is projected to grow from $226.0bn in 2020 to $294.2bn in 2025, in terms of written premiums, according to GlobalData, a leading data, and analytics company.

GlobalData’s insight report, ‘2021 Global Motor Insurance Market’, reveals that the motor insurance industry in Asia-Pacific will grow at a compound annual growth rate (CAGR) of 5.4% over 2020–2025, supported by the recovery in new vehicle sales and product innovation in motor insurance.

Kotu Keerthi Naimisha, Insurance Analyst at GlobalData, comments: “After registering 0.4% growth in 2020, APAC region’s motor insurance industry is expected to report strong recovery with 5.1% growth in 2021. Recovery in vehicle sales, new product development coupled with the easing of lockdown restrictions will support demand for motor insurance.”

Recovery in vehicle sales in 2021 is mainly driven by growing sales of electric vehicles (EV) as many economies aim to phase out internal combustion engine vehicles as part of their climate goals. For instance, Singapore aims to phase out diesel-powered vehicles by 2025, as a result, EV sales rose by over 80% during January–September 2021.

Insurers are also focusing on product innovation to drive sales. Pay-as-you-go and short-term car insurance are examples of products that gained traction during the lockdown as demand for customized motor insurance surged particularly from ride-share services providers such as Uber, Tada (South Korea), and Ola (India).

China is the largest motor insurance market in the region with a 52.9% share of premiums in 2020. The country’s growing middle-income population and rising disposable income are the key drivers of motor insurance growth. The motor insurance premium in China is expected to grow by 5.7% in 2021.

China’s motor insurance industry will also be supported by the undergoing reforms through which the regulator aims to control premium prices and develop commercial motor insurance. The penetration of commercial motor insurance is very low in the country due to a lack of insurance availability and high premiums. With this reform, motor liability premium prices were lowered by up to 50%.

Japan, South Korea, Australia, and India are among the region’s top five markets, with a collective share of 39.9% in 2020. Motor insurance premiums in these markets are expected to grow by 2.5%, 3.7%, 13.8%, and 3.2%, respectively, in 2021.

Naimisha concludes: “APAC motor insurance industry is expected to maintain its growth trend over the next five years. However, the industry is exposed to the resurgence of COVID-19 pandemic and the ongoing supply chain disruption, which can impact the premium growth.”

Leave a Reply