General insurers in Japan shift focus from motor to property and specialty lines, finds GlobalData

In a highly concentrated Japanese general insurance market, insurers are changing their focus towards property and specialty lines due to decline in motor insurance premiums, finds GlobalData, a leading data and analytics company.

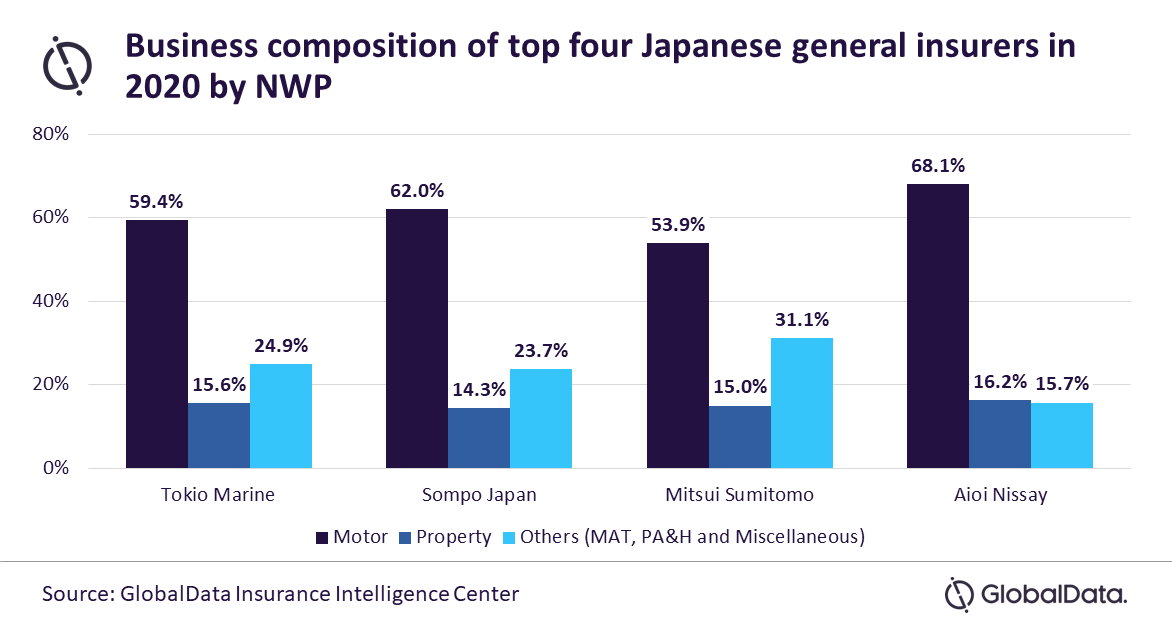

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: “The Japanese general insurance market has been dominated by four leading insurers, which accounted for 87% of the net written premiums (NWP) in 2020. The combined premiums of the top four insurers contracted by 0.2% in 2020 due to a decline in motor insurance premium, driven by a reducing vehicle sales and reduction in premium rates over the previous years.”

According to the Statistics of Japan, traffic accidents have decreased at a CAGR of 12.7% during 2016-2020, which prompted insurers to reduce premium on compulsory motor third-party insurance twice during the last five years. Declining premium has impacted growth of motor insurers, which were already facing pressure due to sluggish business environment and declining vehicle sales. As a result, motor insurance declined at a CAGR of 0.3% during 2016-20. The share of motor insurance business for the top four insurers declined from 63.3% in 2016 to 60.5% in 2020.

On the other hand, property insurance premium rates registered double-digit growth in 2020, and subsequently became the focus area for general insurers. Property insurance segment grew at a CAGR of 5.2% during 2016-2020, driven by increase in reinsurance premium rates and increased risks associated with natural catastrophic (Nat-cat) events. Consequently, property insurance share within total premium for the top four insurers increased from 12.9% in 2016 to 15.2% in 2020.

Apart from property insurance, insurers are also focusing on specialty insurance lines such as cybersecurity, event cancellation, and business interruption.

Sahoo concludes: “With the country’s vulnerability to natural catastrophic events and increasing cybercrime cases, insurers are expected to be more aggressive with product innovation in these segments, which will support their demand over the next few years.”

Leave a Reply