THE TIME HAS COME FOR IRDAI TO REVIEW IT’S INSURANCE DISTRIBUTION POLICY

The measure of insurance penetration and density reflects the level of development of the sector. While insurance penetration is measured as the percentage of the insurance premium to GDP, insurance density is calculated as the ratio of premium (in US $) to the total population (per capital premium). In terms of segments, the penetration of life insurance industry remained unchanged at 2.72% in FY 2016-17. However, the insurance density of life insurers increased exponentially from $ 43.20 in 2015-16 to $ 46.50 in FY 2016-17. On the other hand, the non-life insurance industry saw a marginal growth in its penetration. The industry recorded a penetration of 0.77% in FY 2016-17 compared to 0.72% in FY 2015-16. However, the density of non-life insurers grew marginally from$11.5 in FY 2015-16 to $13.2 in FY 2016-17. Over the last 10 years, the penetration of non life insurance sector in the country remained steady in the range of 0.5-0.8 per cent. Its density has gone up from USD 2.4 in 2001 to USD 13.2in 2016. In India, insurance is not bought voluntarily but requires a lot of concerted efforts to sell a policy. Especially health insurance, which is seen as redundant due to the mindset of the buyer who rubbishes the fact about the possibility of a health emergency being diagnosed in their lifetime. It is a fact that critical illness and health emergencies are being diagnosed at an exponential rate due to poor lifestyle and dietary patterns. The Boston Consulting Group estimates digital payments in India will exceed USD 500 billion by 2020, up from USD 50 billion in 2016. There is immense potential and with the Indian consumer adopting technology rapidly and the government driving digital payments, there is a much greater probability of converting this potential into reality. Insurers invest in India by adapting technology that has been successful in other parts of the world and is suitable to the Indian market. They also innovate and build in India, which itself is a hub of payments innovation right now. The insurance industry is witnessing growth and is projected to have great times in the years to come. This offers immense scope for consolidation as some promoters may look at exiting non-core businesses and existing large insurers desire to achieve scale and bring in better synergies to pass on the cost efficiencies to customers and shareholders.

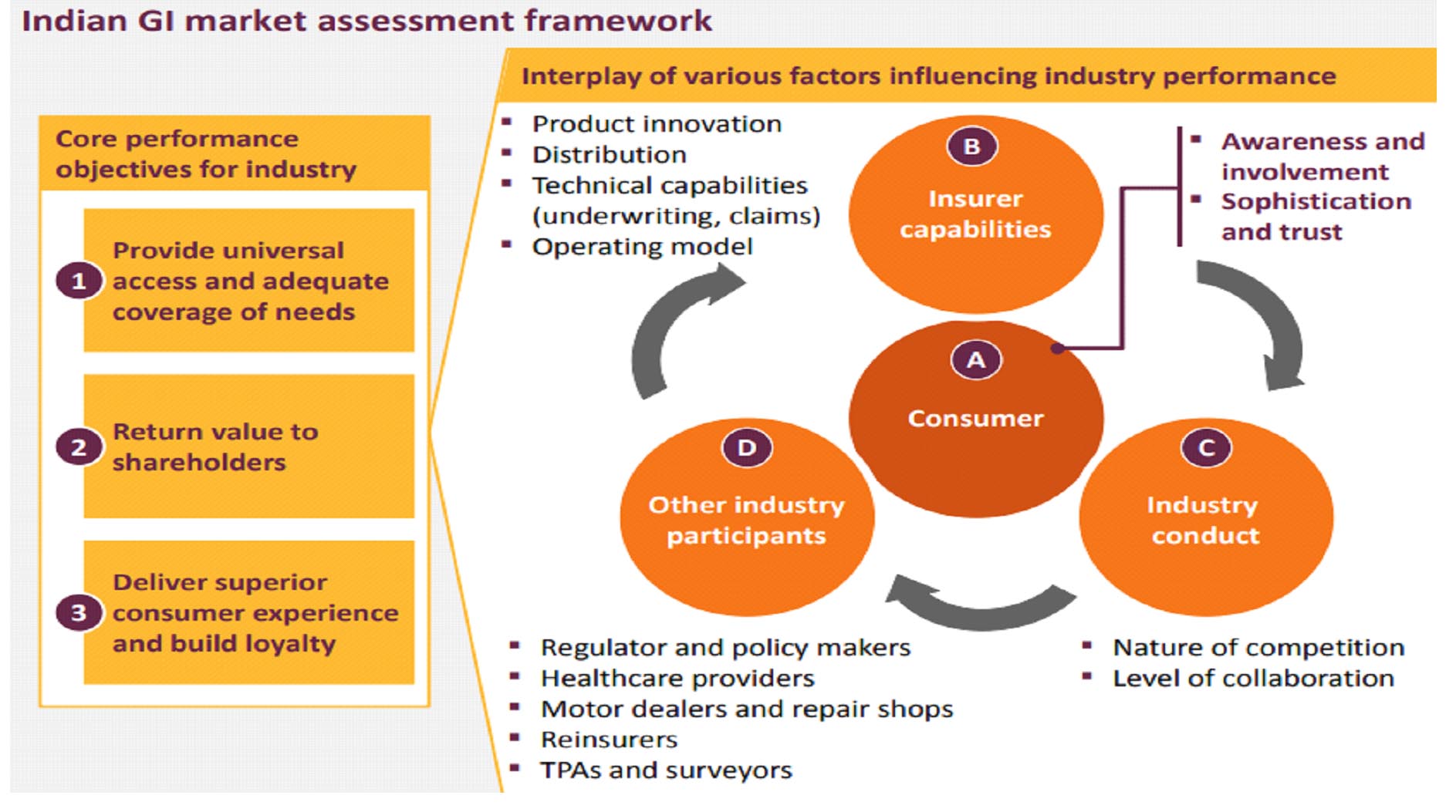

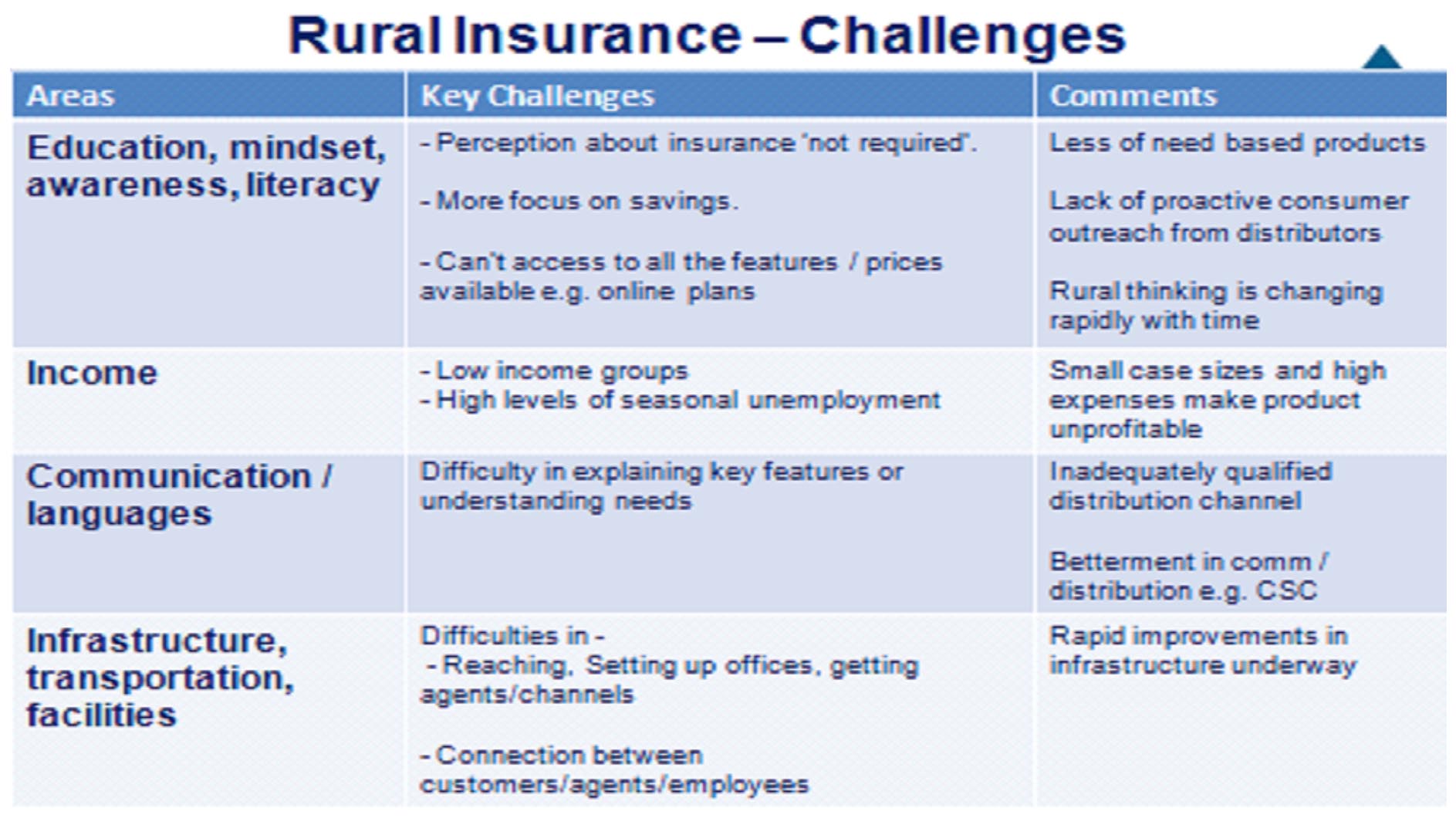

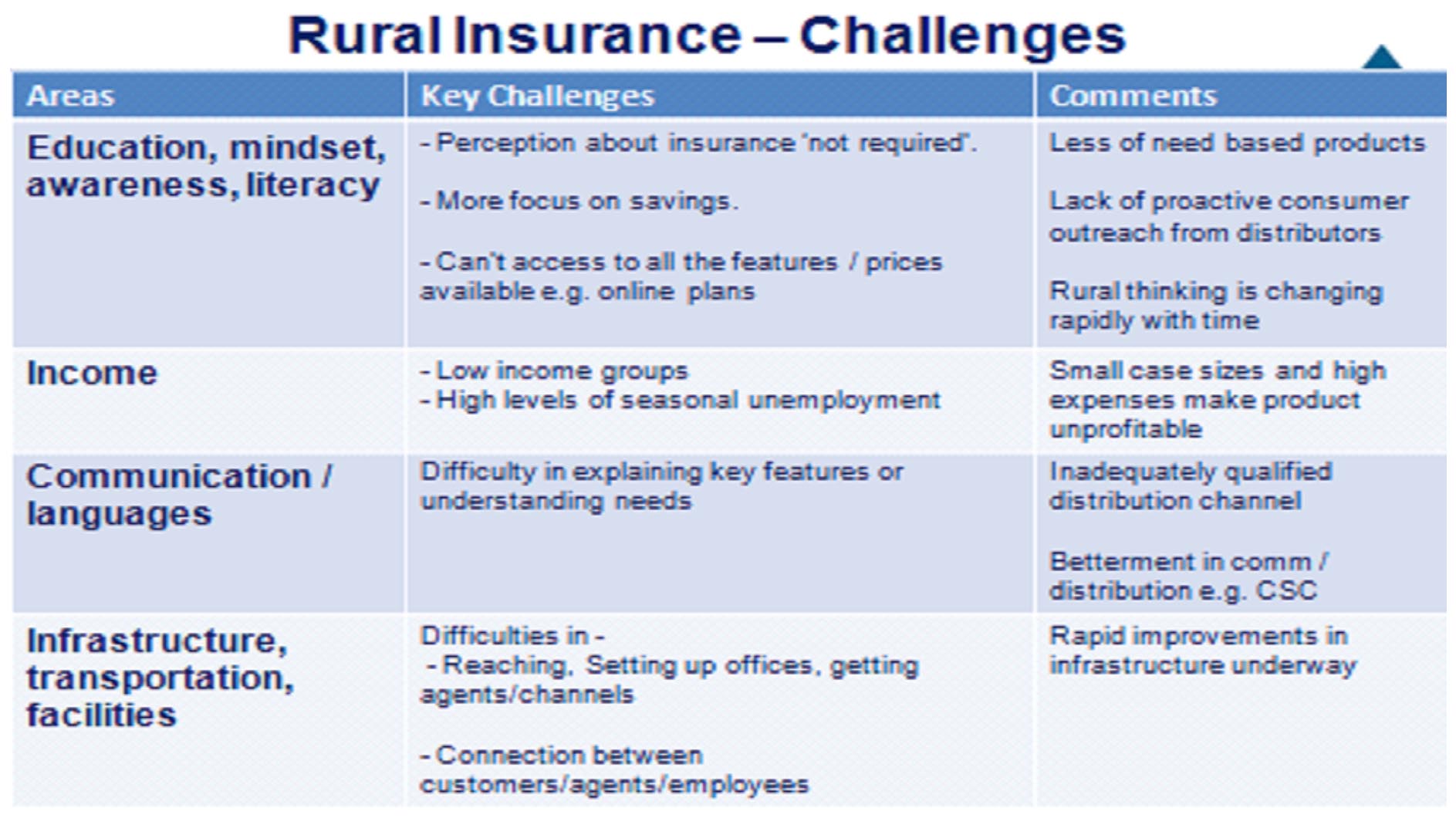

Insurance is based on trust. Once that is established, its benefits can be better explained. Insurance penetration is low in the rural sector. To increase the penetration, product customization is essential. Rural population needs to understand the benefits and trust the insurance provider. For the rural customer, with limited funds available, safety of the invested funds is naturally of paramount importance. The year 2017-18 witnessed the entry of new players like Acko General Insurance Company, DHFL General Insurance, Edelweiss General Insurance Company Limited and Go Digit General Insurance. With this, there are now 10 re-insurance companies, 24 life insurers and 33 general insurers, including 6 standalone health insurance companies, in India. The insurance sector is growing at a rapid pace, particularly the health insurance segment. Technology-led disruptive ideas are changing the face of business and the category per se is booming with new products being launched and the distribution network being expanded. This trend will continue and insurers will focus on tech-driven ideas. Though demonetisation and GST have disrupted the business and economic growth in the short run, the growth momentum will return after the economy stabilises. The norms were aimed at ensuring insurers followed prudent practises on management of risks arising out of outsourcing so as to prevent negative systemic impact on the one hand and protect the interests of policyholders on the other.

SALES RELATIONSHIP:

Insurance products are mostly sold by agents who already know their customers. There is already some kind of a relationship between an insurance sales agent and the buyer. Most probably, the insurance agent is your next-door neighbour, so there is an element of trust involved. Insurance products have some of the most emotional advertisements on television. They are very effective and stay on the minds of the consumer for a longer time. Life Insurance products are sold on emotions and general insurance products are sold on compulsion. Emotional products always have a way of attracting the buyer. Be it a cell phone used to call the daughter, a chocolate advertisement which shows the bond between a mother and her son or a textile brand advertisement where emotions are shown to show bonds between different members of a family. The end buyer is getting smarter and now understands the old school methods of selling financial products, especially in major cities. However, with a 14 percent financial literacy rate across the country, most will struggle to differentiate between a mutual fund and an insurance product or for that matter any financial product. The key is to have a level-playing field for all financial products, starting with communication and some agreed norms of disclosure.

SELLING INSURANCE TO DOWNTRODDENS:

The evidence from the many recent attempts to sell various kinds of insurance to the poor in India and other less developed countries confirms that these are major concerns for the buyers. They are not insurmountable but demand imaginative solutions. For example, the pensions ought to be indexed — after all, the poor, quite justifiably, do not want to bear the inflation risk, and indeed why would we want them to be the victims of the government’s caprice. Even more importantly, the government must not lose sight of the fact that not everyone in India is in a position to make a living. Go to a village and ask who the poor are and people who are themselves very poor will point to certain households that they help and worry about: Households that live off handouts, households of women and young children quite often, where the man is either disabled, a drunk, dead or just gone. To offer them insurance now or to ask them to contribute to a pension would be a cruel joke. But that does not mean that there is nothing that the State can do to help these ultra-poor. In India, per capita consumption is up by 11%, and food consumption and incomes by more than that. These households are obviously still very poor — indeed unacceptably so — but they are able to join the ranks of the “normal” poor, who are mostly economically self-sustaining. And the fact that the effect is persistent means that the economic return on such investments can be substantial — in India the benefit/cost ratio is projected to be more than 4 to 1.The assumption behind this shift is that people can find ways to sustain themselves as long as they are able-bodied and of working age, but the government needs to help them deal with the stuff that are beyond their control, like old age, disability and death. Families need disability insurance and life insurance because losing the main earning member is one of the easiest ways to fall into desperate poverty.

SALE OF GOVERNMENT SPONSORED PRODUCTS:

Government-sponsored pensions and insurance schemes have of course been there for many years. What is striking is the fact that this government has decided to make them the centerpiece of its anti-poverty efforts, rather than something that gets announced during a budget speech as a sop to a particular constituency and then largely forgotten. There are several issues here. One is the fear that by the time they get the payback inflation would have eaten through it. Another is the not unreasonable suspicion that when it comes to paying out, the person in charge will be incredibly slow and/or demand a bribe. A third is that while death should be easy to establish, disability is not, unless it leaves out everything but the loss of a limb or a sensory organ. Crippling back pain as a result of a workplace injury, for example, is hard to prove, which means whether or not it gets counted will depend on someone’s discretion. Distribution outside large cities is poor. General insurers have about 10,000 branches, of which 57% are in tier I cities with a population of over 100,000. For the private sector, 96% are in these larger cities. Brokers, typically a large distribution channel for general insurance, have 85% of their 385 corporate offices in just seven states, most in the large capitals of Mumbai and Delhi. This means that there are large parts of the country where access to general insurance is limited. The reason insurers and distributors do not build a presence in small towns is that it is unviable. A salesperson in a tier 2 town will have to sell over 10 covers a month to just recover her salary. That’s extremely difficult. In the much better distributed life insurance sector, agents sell just 3-4 insurance covers each month. The solution to this is to allow distributors to earn more when they step outside large cities.

INSURANCE IS A NECESSITY:

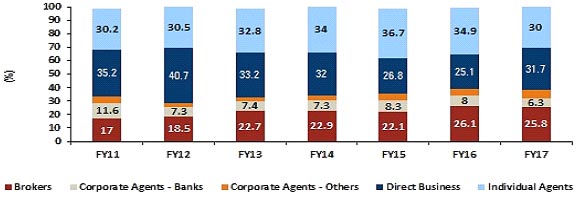

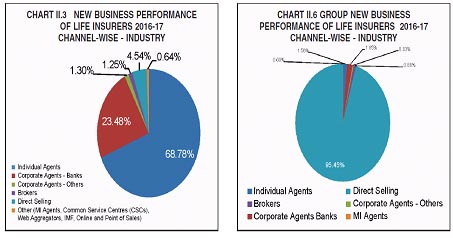

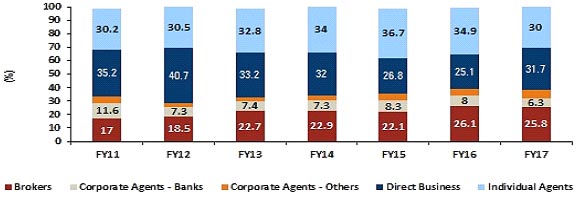

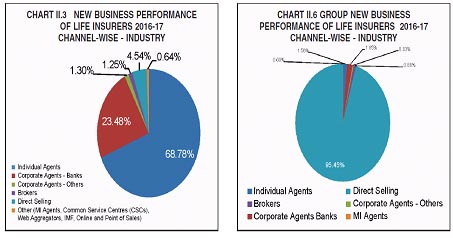

Today almost everybody who is starting to earn is taking insurance. There are some possible reasons why people are doing so. One of the most common reasons that people give today is to save tax. Apart from tax saving, the other big reason is of course safety. The main benefit of insurance is to provide support at times of need. Some agents and companies offer insurance policies at their office. But people prefer to take online insurance today. Why is it so? Today everyone has become so busy that no one has that much time to visit different insurance offices to check the policies and then buy a plan. In this case, online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Today people are more into comparing things before buying. Even in a case of insurance policy, people like to compare 2-3 companies before settling on one. Comparing becomes hectic when you are confused in between 2-3 brands. Indian non-life insurers employ a multi-channel approach to market and sell their products, including individual agents, bank partners, other corporate agents, brokers, direct sales and online channels. In FY11-16, proportion of broker and individual agent has been on the rise increasing from 17% & 26.1% to 30.2% & 34.9%, respectively. This shift can be partially attributed to increased usage of online & mobile platform by retail customers. The trend today is toward disintermediation. The Internet has facilitated a certain amount of disintermediation by making it easier for consumers and businesses to contact one another without going through any middlemen.

SELLING INSURANCE TO DOWNTRODDENS:

The evidence from the many recent attempts to sell various kinds of insurance to the poor in India and other less developed countries confirms that these are major concerns for the buyers. They are not insurmountable but demand imaginative solutions. For example, the pensions ought to be indexed — after all, the poor, quite justifiably, do not want to bear the inflation risk, and indeed why would we want them to be the victims of the government’s caprice. Even more importantly, the government must not lose sight of the fact that not everyone in India is in a position to make a living. Go to a village and ask who the poor are and people who are themselves very poor will point to certain households that they help and worry about: Households that live off handouts, households of women and young children quite often, where the man is either disabled, a drunk, dead or just gone. To offer them insurance now or to ask them to contribute to a pension would be a cruel joke. But that does not mean that there is nothing that the State can do to help these ultra-poor. In India, per capita consumption is up by 11%, and food consumption and incomes by more than that. These households are obviously still very poor — indeed unacceptably so — but they are able to join the ranks of the “normal” poor, who are mostly economically self-sustaining. And the fact that the effect is persistent means that the economic return on such investments can be substantial — in India the benefit/cost ratio is projected to be more than 4 to 1.The assumption behind this shift is that people can find ways to sustain themselves as long as they are able-bodied and of working age, but the government needs to help them deal with the stuff that are beyond their control, like old age, disability and death. Families need disability insurance and life insurance because losing the main earning member is one of the easiest ways to fall into desperate poverty.

SALE OF GOVERNMENT SPONSORED PRODUCTS:

Government-sponsored pensions and insurance schemes have of course been there for many years. What is striking is the fact that this government has decided to make them the centerpiece of its anti-poverty efforts, rather than something that gets announced during a budget speech as a sop to a particular constituency and then largely forgotten. There are several issues here. One is the fear that by the time they get the payback inflation would have eaten through it. Another is the not unreasonable suspicion that when it comes to paying out, the person in charge will be incredibly slow and/or demand a bribe. A third is that while death should be easy to establish, disability is not, unless it leaves out everything but the loss of a limb or a sensory organ. Crippling back pain as a result of a workplace injury, for example, is hard to prove, which means whether or not it gets counted will depend on someone’s discretion. Distribution outside large cities is poor. General insurers have about 10,000 branches, of which 57% are in tier I cities with a population of over 100,000. For the private sector, 96% are in these larger cities. Brokers, typically a large distribution channel for general insurance, have 85% of their 385 corporate offices in just seven states, most in the large capitals of Mumbai and Delhi. This means that there are large parts of the country where access to general insurance is limited. The reason insurers and distributors do not build a presence in small towns is that it is unviable. A salesperson in a tier 2 town will have to sell over 10 covers a month to just recover her salary. That’s extremely difficult. In the much better distributed life insurance sector, agents sell just 3-4 insurance covers each month. The solution to this is to allow distributors to earn more when they step outside large cities.

INSURANCE IS A NECESSITY:

Today almost everybody who is starting to earn is taking insurance. There are some possible reasons why people are doing so. One of the most common reasons that people give today is to save tax. Apart from tax saving, the other big reason is of course safety. The main benefit of insurance is to provide support at times of need. Some agents and companies offer insurance policies at their office. But people prefer to take online insurance today. Why is it so? Today everyone has become so busy that no one has that much time to visit different insurance offices to check the policies and then buy a plan. In this case, online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Today people are more into comparing things before buying. Even in a case of insurance policy, people like to compare 2-3 companies before settling on one. Comparing becomes hectic when you are confused in between 2-3 brands. Indian non-life insurers employ a multi-channel approach to market and sell their products, including individual agents, bank partners, other corporate agents, brokers, direct sales and online channels. In FY11-16, proportion of broker and individual agent has been on the rise increasing from 17% & 26.1% to 30.2% & 34.9%, respectively. This shift can be partially attributed to increased usage of online & mobile platform by retail customers. The trend today is toward disintermediation. The Internet has facilitated a certain amount of disintermediation by making it easier for consumers and businesses to contact one another without going through any middlemen.

ONLINE CHANNELS ARE AHEAD OF ALL:

Gone are the days when people just researched about the particular insurance company and then contacted their agents to buy the policy. Now the online payment mode is comfortable and safe and you can buy virtually anything online. This feature has boosted the prospects and scope of online insurance in India significantly. In fact, this is why the popularity of online insurance has enhanced significantly over the years in India. Online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Also, you get an appropriate amount of time to do proper research before buying the policy. Also, the cost of an online policy is less as compared to an offline one since there is no middlemen involved. Online marketing and services are spreading at a lightning speed to almost all the corners of the world. A developing country like India has also been touched by the online services and now almost everything in India is going online. The limit is not only the online shopping and the social networks. Nearly every service from financial to educational and many more are going online so that you do not have to go out anywhere to fetch a particular service. The Internet has also made it easier for buyers to shop for the lowest prices on products. Today, most people buy and renew their policies online without going through any intermediary.

RURAL CHALLENGES:

There is a drastic shift in people wanting insurance. One needs to have insurance as an instrument to maintain the overall financial well being. Although the thumb rule of having a life insurance cover of 10-times your income still exists, in reality it is more complex than that, and is typically tailor made. Once you have defined your goals, your death is a financial loss and, hence, you need to calculate how much those goals cost today (if death were to happen today) plus a certain amount of kitty (for ongoing income), whatever is the corpus is your financial loss. From this amount, once you reduce your existing policy, you arrive at your net loss, which is the amount of insurance you need. More the assets, less the cover. However, if you have more loans and more dependants, and your aspirations are higher, you need more cover. Previously there was only the fear of dying; now there is fear of living, too. People have started thinking in terms of disability, medical as well as pension cover. However, in rural India, there is still a large amount of push needed. Currently, they can get a term assurance plan offered through the Pradhan Mantri Suraksha Bima Yojna (PMSBY), which covers them for Rs 2 lakh at a premium of Rs 330 annually. Hence, there is a start.

ONLINE CHANNELS ARE AHEAD OF ALL:

Gone are the days when people just researched about the particular insurance company and then contacted their agents to buy the policy. Now the online payment mode is comfortable and safe and you can buy virtually anything online. This feature has boosted the prospects and scope of online insurance in India significantly. In fact, this is why the popularity of online insurance has enhanced significantly over the years in India. Online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Also, you get an appropriate amount of time to do proper research before buying the policy. Also, the cost of an online policy is less as compared to an offline one since there is no middlemen involved. Online marketing and services are spreading at a lightning speed to almost all the corners of the world. A developing country like India has also been touched by the online services and now almost everything in India is going online. The limit is not only the online shopping and the social networks. Nearly every service from financial to educational and many more are going online so that you do not have to go out anywhere to fetch a particular service. The Internet has also made it easier for buyers to shop for the lowest prices on products. Today, most people buy and renew their policies online without going through any intermediary.

RURAL CHALLENGES:

There is a drastic shift in people wanting insurance. One needs to have insurance as an instrument to maintain the overall financial well being. Although the thumb rule of having a life insurance cover of 10-times your income still exists, in reality it is more complex than that, and is typically tailor made. Once you have defined your goals, your death is a financial loss and, hence, you need to calculate how much those goals cost today (if death were to happen today) plus a certain amount of kitty (for ongoing income), whatever is the corpus is your financial loss. From this amount, once you reduce your existing policy, you arrive at your net loss, which is the amount of insurance you need. More the assets, less the cover. However, if you have more loans and more dependants, and your aspirations are higher, you need more cover. Previously there was only the fear of dying; now there is fear of living, too. People have started thinking in terms of disability, medical as well as pension cover. However, in rural India, there is still a large amount of push needed. Currently, they can get a term assurance plan offered through the Pradhan Mantri Suraksha Bima Yojna (PMSBY), which covers them for Rs 2 lakh at a premium of Rs 330 annually. Hence, there is a start.

PRODUCT INNOVATION:

Introducing a completely revamped product portfolio is a big effort. Introducing new products, training the sales force and getting the momentum back in sales are all big challenges. Product innovation is happening and owing to the Insurance and Regulatory Development Authority (IRDA) regulations, traditional products are also becoming very transparent for the insured, specifying the minimum payout that has to be made to policy holders as well. It is only a matter of time before insurance picks up, considering we are seeing the economy showing an upward trend. Purchasing power is increasing; however, the share of insurance to GDP has not increased in that proportion. A large number of product variants are available and we would also like more in the health care sector. Apart from illnesses, we have people living much longer who require cover where treatments are taken at home, long-term care products, wherein you pay your premium during your work life and get the benefits on retirement, including nursing treatment, etc. If somebody is willing to pay more premiums, treatment across the globe should also be available. India is under insured due to a variety of factors, including how much people are willing to invest in insurance and, the fact that, products used to be complicated. Things have changed. You can now buy insurance with ease and more products are available at cheaper costs. In the UK, there is basic stakeholder insurance for the masses; we have the Government of Indian doing it.

MIS-SELLING ALSO PREVAILS:

Even though banks may have taken necessary action against erring employees and also refunded the premium to customers, these steps are not enough, the circular stated. The regulator wants banks and NBFCs to have a system that proactively detects and discourages such kinds of mis-selling. It has also asked insurers to comply with rules and disclose details of Specified Persons (SP). These are individuals responsible for selling insurance plans in banks. Giving out details will help ascertain which SP was responsible for mis-selling. Banks act as corporate agents through bancassurance agreements with insurance companies. Currently, over 400 corporate agents have registered with IRDAI to sell insurance products. The most commonly used method is to bundle an insurance policy with a loan. The policy is sold as a compulsory requirement to taking a loan and is bundled despite express unwillingness of customers. You should know that buying insurance is not mandatory when taking a loan, but it is advisable to buy a term insurance policy to cover big ticket loans such as a home loan. What you also need to be wary of is that banks may want to sell you a single premium policy and bundle the premium in the loan amount. This increases your equated monthly instalment (EMI) since it also includes the premium. Don’t bundle the premium with the loan. Buy a regular premium policy instead.

Banks also make purchase of insurance a mandatory prerequisite to opening a bank locker. Again, this is not as per regulations. Banks could even insist on an insurance-cum-investment plan, which is irrelevant to opening a locker. The single-premium policies were issued in place of fixed deposits stating better benefits. A fixed deposit is a pure investment product with a guaranteed rate of return, whereas an insurance savings plan is a bundled product which may or may not guarantee the return. Further, insurance plans come with high surrender costs. Fixed deposits and insurance are not substitutable. Buy a product with a goal in mind and one that meets that goal most efficiently. The regulator also received complaints about policies being sold without customers’ consent or signatures, and with incorrect contact details. There have also been instances of banks selling regular premium policies in place of single-premium policies and debiting renewal premiums from customer’s bank account without any intimation. This is a clear case of misconduct and if you have been a victim to such malpractice you can take it up using the Integrated Grievance Management System, and ultimately the insurance ombudsman.

PRODUCT INNOVATION:

Introducing a completely revamped product portfolio is a big effort. Introducing new products, training the sales force and getting the momentum back in sales are all big challenges. Product innovation is happening and owing to the Insurance and Regulatory Development Authority (IRDA) regulations, traditional products are also becoming very transparent for the insured, specifying the minimum payout that has to be made to policy holders as well. It is only a matter of time before insurance picks up, considering we are seeing the economy showing an upward trend. Purchasing power is increasing; however, the share of insurance to GDP has not increased in that proportion. A large number of product variants are available and we would also like more in the health care sector. Apart from illnesses, we have people living much longer who require cover where treatments are taken at home, long-term care products, wherein you pay your premium during your work life and get the benefits on retirement, including nursing treatment, etc. If somebody is willing to pay more premiums, treatment across the globe should also be available. India is under insured due to a variety of factors, including how much people are willing to invest in insurance and, the fact that, products used to be complicated. Things have changed. You can now buy insurance with ease and more products are available at cheaper costs. In the UK, there is basic stakeholder insurance for the masses; we have the Government of Indian doing it.

MIS-SELLING ALSO PREVAILS:

Even though banks may have taken necessary action against erring employees and also refunded the premium to customers, these steps are not enough, the circular stated. The regulator wants banks and NBFCs to have a system that proactively detects and discourages such kinds of mis-selling. It has also asked insurers to comply with rules and disclose details of Specified Persons (SP). These are individuals responsible for selling insurance plans in banks. Giving out details will help ascertain which SP was responsible for mis-selling. Banks act as corporate agents through bancassurance agreements with insurance companies. Currently, over 400 corporate agents have registered with IRDAI to sell insurance products. The most commonly used method is to bundle an insurance policy with a loan. The policy is sold as a compulsory requirement to taking a loan and is bundled despite express unwillingness of customers. You should know that buying insurance is not mandatory when taking a loan, but it is advisable to buy a term insurance policy to cover big ticket loans such as a home loan. What you also need to be wary of is that banks may want to sell you a single premium policy and bundle the premium in the loan amount. This increases your equated monthly instalment (EMI) since it also includes the premium. Don’t bundle the premium with the loan. Buy a regular premium policy instead.

Banks also make purchase of insurance a mandatory prerequisite to opening a bank locker. Again, this is not as per regulations. Banks could even insist on an insurance-cum-investment plan, which is irrelevant to opening a locker. The single-premium policies were issued in place of fixed deposits stating better benefits. A fixed deposit is a pure investment product with a guaranteed rate of return, whereas an insurance savings plan is a bundled product which may or may not guarantee the return. Further, insurance plans come with high surrender costs. Fixed deposits and insurance are not substitutable. Buy a product with a goal in mind and one that meets that goal most efficiently. The regulator also received complaints about policies being sold without customers’ consent or signatures, and with incorrect contact details. There have also been instances of banks selling regular premium policies in place of single-premium policies and debiting renewal premiums from customer’s bank account without any intimation. This is a clear case of misconduct and if you have been a victim to such malpractice you can take it up using the Integrated Grievance Management System, and ultimately the insurance ombudsman.

“POSP” TO GAIN MOMENTUM:

As per the IRDAI guidelines, life insurers can sell pure term insurance products, immediate annuity products and non-linked non-participating endowment products through the POSPs. In the general insurance sector, IRDAI has said that POSPs can sell policies such third party motor insurance, personal accident policy, cattle insurance, home insurance policy as well as travel insurance policy. The regulator has clarified that POS products would have to be plain vanilla products that are easy to understand and simple to sell. The general insurance industry will now look at selling motor insurance policies through the POSP, if we have adequate numbers. Apart from the regular policies, IRDAI has allowed POSPs to sell crop insurance (government insurance schemes such as Pradhan Mantri Fasal Bima Yojana), Weather Based Crop Insurance Scheme (WBCIS) and Pradhan Mantri Jeevan Suraksha Bima Yojana. Companies are now involved in designing and filing products for this distribution channel. Insurers have also been asked to file half-yearly returns for the POS products. IRDAI has defined the features of the products and the sum assured allowed under the schemes. For instance, the regulator has said that in case of a pure term product, the maximum sum assured that permissible to be sold be POSPs would be Rs 25 lakh. Further, the insurers will not be allowed to provide a return of premium feature for them. Insurance companies have started designing specialised policies to be sold by Point of Sales Persons (POSPs).

NEWER DISTRIBUTION CHANNELS:

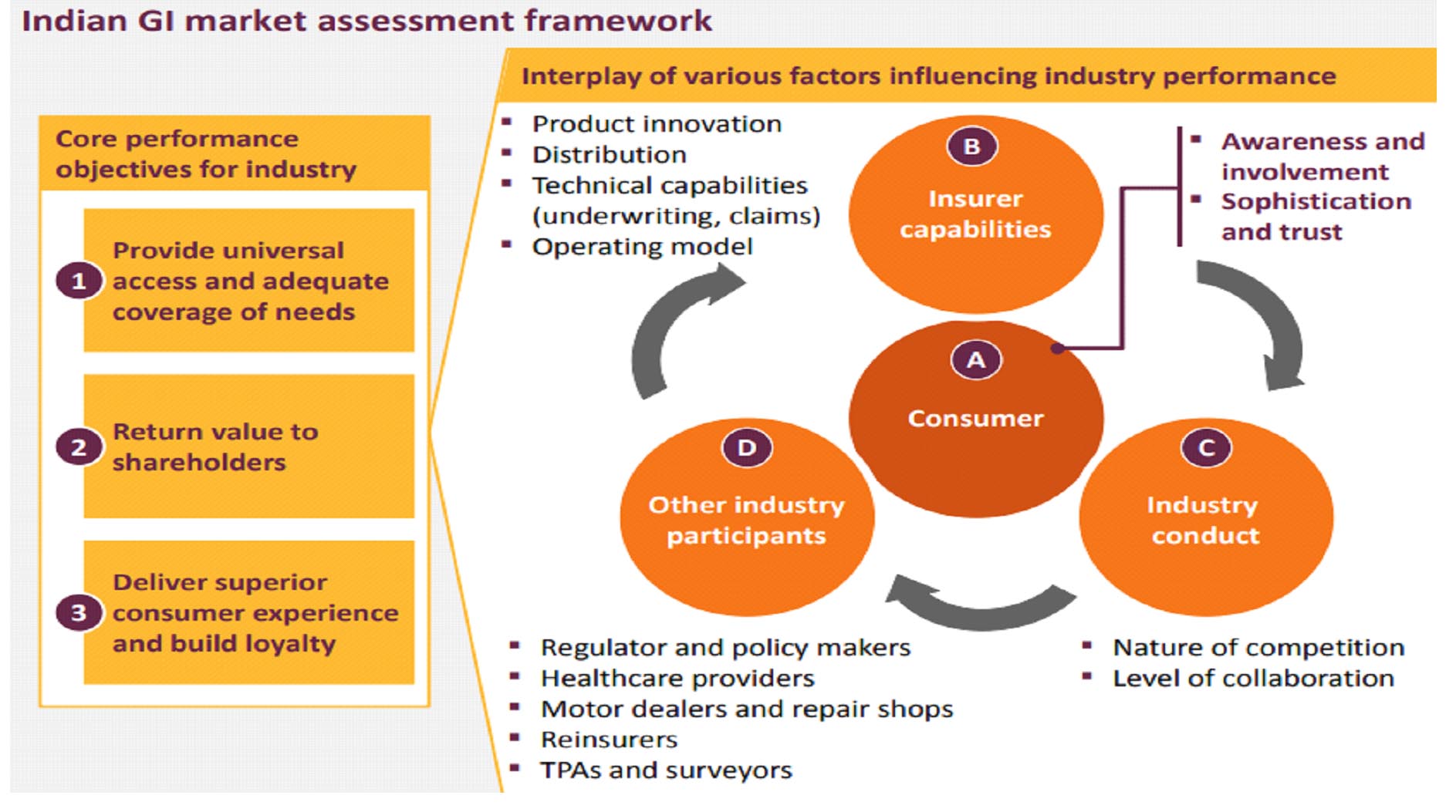

There is no point in doing 30 products when at the end of the day only five are getting sold. One also needs to understand the bandwidth of an agent to understand so many products. But at the same time, there is a need to recognize the distribution channels. The insurance distribution scenario is dynamic and complex. Traditionally, in insurance, agent-driven selling has been the dominant method and may continue to be so in the future. However, alternate channels of distribution are also rapidly emerging and enabling companies to grow their customer reach. Insurers are looking at ways to cope with multiple distribution channels, multi-dimensional relationships and hierarchies. Other challenges lay in the labour intensive management of a large distribution sales force, regulatory compliance, performance monitoring and motivation initiatives. Tackling these challenges require automation, agility and innovation without sacrificing compliance. The attractiveness of India has always been the sheer size of the market and to tap such vast market, finding the right distribution model to address the different target segments is of grave importance. As sale of new policies and increasing the penetration of health insurance is one of the levers of creating profits, the first wave of insurance companies concentrated on building a distribution model to enable this lever. In that context, now banks are allowed to sale products of two general, two life insurance company and two health insurance companies. Since newer distribution infrastructure would be expensive, the regulator has also looked at utilising existing networks like CSCs. Insurance companies could tie up with CSCs to act as insurance brokers. However, due to the expense management norms, insurers are not finding it cost-effective to partner CSCs. CSCs will offer web-enabled e-governance services in rural areas. They can offer application forms, certificates, and utility payments. With costs under pressure, newer channels like online brokers and web aggregators are also catching up. The Insurance Laws (Amendment) Act 2015 (Amendment Act) omitted §40A of the Insurance Act 1938 and set the backdrop for commission and remuneration limits to be revised. In the interim, Life Insurers were still restricted to the limits specified in the Products Regulations for products being launched or the limits set out in the IRDAI approved File & Use application for existing products and General Insurers are still restricted to the maximum commission amounts notified by the IRDAI through its circulars. A problem that has worsened over the years is that insurers have been focusing on growing sales even if that creates a distortion in pricing for individuals.

LACK OF MANDATE:

Internationally, mandating purchase of insurance covers is common, particularly in areas where an employer needs to be nudged to provide a cover to employees. In China, motor insurance, professional indemnity, health insurance, public liability insurance, work-related injury insurance and environment liability covers are mandatory for segments most exposed to these risks. The UK requires most services to buy professional indemnity and comprehensive general liability, apart from standard motor insurance. The government in India should consider mandating property, catastrophe and certain liability insurances. Making these compulsory will result in prices falling to an extent that these become marginal incremental costs. Even in case of third-party motor insurance which is mandatory, there are about 40% uninsured vehicles on the road. Insurance penetration in India is low, particularly for general insurance, which includes motor, health, property and liability covers. We buy about Rs750 of general insurance per person per year compared to over Rs 6,500 in Russia, China or Brazil, according to a report by the International Monetary Fund (IMF). If we measure premiums as a proportion of GDP, India is at 0.7% as compared to a world average of 2.8%. General insurance is colloquially referred to as non-life, a reflection of its poor-cousin status compared to the larger life insurance sector.

Over the past decade, many new distribution channels have been created—agents, corporate agents, web aggregators, brokers and insurance marketing firms. For a customer, the distinction between these channels is blurred. Both corporate agents and brokers can offer products of multiple insurers. This makes it hard for customers to know whether the distributor is representing their interest or the insurers’. Distribution could be simplified to just two models, agents and brokers. Agents sell one insurer’s products and represent the insurer, whereas brokers, who operate with an open architecture, sell multiple insurers’ products and represent clients. The Indian market has many peculiarities – cultural divide, changing demographics, and geographical complexities apart from a stringent regulatory environment. To survive and more importantly grow in this market, health insurance companies require multiple strategies for distribution. Insurance companies desperately need a new ways to manage its distribution of products, ones that support sales without creating unmanageable rise in distribution costs. Insurance is a multiple transformation industry. Few are looking at being the leading digital insurance company because they are not tied down to a secondary interest – there’s no bank, no agency, For insurers to realise the highest value from distribution, they must define an operating model which supports a multi-product, multi-channel distribution model that compliments an insurer’s revenue objectives and profit margins. Distribution is not only the forefront of the operations but also forms a large proportion of the operating expenses. Insurers can realise the highest value from their agent distribution channel by developing an integrated suite of services oriented to driving sales and reducing servicing costs. With distribution remaining a concern area for private players, IRDA can play an enormous role in bringing the sector back on course by approving innovative formats for distribution. For example, approving the setting up of a dedicated franchisee or a dedicated group to act as business associates who will recruit and manage individual agents for health insurance company that has different parameters for business viability. This will create the right atmosphere for creating cost effective distribution and also individual growth for career agents, who are willing to invest their career with Health Insurance Company. Innovation in this area will require a lot of effort.

Digital disruption in the insurance distribution space is the biggest concern for insurance intermediaries like insurance brokers and insurance marketing firms globally. Globally insurance brokers are concerned about their ability to adapt to the emerging technological changes in the insurance distribution space. Insurance intermediaries believe that the innovative technology trends used in insurance distribution and customization of polices would rapidly change the insurance industry. While the regulator has been giving a gentle nudge to make good use of all existing sales channels, the real challenge is that insurers are seeing a big swing in business from one channel to another. When given an equal opportunity to perform, third party intermediaries are of the view that the true potential of the industry will be unlocked. Bringing in newer touch-points to complement the existing points of sales will only lead to more numbers to the overall business, bringing newer dimensions to India’s insurance growth story. It is difficult to adapt to these changes so quickly. With costs under pressure, newer channels like online brokers and web aggregators are also catching up. As technology innovation, higher customer expectations and disruptive newcomers redefine the marketplace, insurers remain focused on growing top-line sales, bottom-line profitability, addressing challenges, and competing in a dynamic industry. Insurers continue to be challenged by rapidly evolving customer needs and expectations amid heightened competition, many have resorted to belt-tightening and “doing more with less” to shore up returns. However, as the pace of productivity improvements slows with existing staff and systems, many carriers are looking to boost their transformation efforts by integrating more advanced automation, fuelled by software applications that run automated tasks, also known as “bots,” as well as machine-learning algorithms. These options give insurers an opportunity not just to reduce expenses, but also to possibly reinvent how they conduct business.

“POSP” TO GAIN MOMENTUM:

As per the IRDAI guidelines, life insurers can sell pure term insurance products, immediate annuity products and non-linked non-participating endowment products through the POSPs. In the general insurance sector, IRDAI has said that POSPs can sell policies such third party motor insurance, personal accident policy, cattle insurance, home insurance policy as well as travel insurance policy. The regulator has clarified that POS products would have to be plain vanilla products that are easy to understand and simple to sell. The general insurance industry will now look at selling motor insurance policies through the POSP, if we have adequate numbers. Apart from the regular policies, IRDAI has allowed POSPs to sell crop insurance (government insurance schemes such as Pradhan Mantri Fasal Bima Yojana), Weather Based Crop Insurance Scheme (WBCIS) and Pradhan Mantri Jeevan Suraksha Bima Yojana. Companies are now involved in designing and filing products for this distribution channel. Insurers have also been asked to file half-yearly returns for the POS products. IRDAI has defined the features of the products and the sum assured allowed under the schemes. For instance, the regulator has said that in case of a pure term product, the maximum sum assured that permissible to be sold be POSPs would be Rs 25 lakh. Further, the insurers will not be allowed to provide a return of premium feature for them. Insurance companies have started designing specialised policies to be sold by Point of Sales Persons (POSPs).

NEWER DISTRIBUTION CHANNELS:

There is no point in doing 30 products when at the end of the day only five are getting sold. One also needs to understand the bandwidth of an agent to understand so many products. But at the same time, there is a need to recognize the distribution channels. The insurance distribution scenario is dynamic and complex. Traditionally, in insurance, agent-driven selling has been the dominant method and may continue to be so in the future. However, alternate channels of distribution are also rapidly emerging and enabling companies to grow their customer reach. Insurers are looking at ways to cope with multiple distribution channels, multi-dimensional relationships and hierarchies. Other challenges lay in the labour intensive management of a large distribution sales force, regulatory compliance, performance monitoring and motivation initiatives. Tackling these challenges require automation, agility and innovation without sacrificing compliance. The attractiveness of India has always been the sheer size of the market and to tap such vast market, finding the right distribution model to address the different target segments is of grave importance. As sale of new policies and increasing the penetration of health insurance is one of the levers of creating profits, the first wave of insurance companies concentrated on building a distribution model to enable this lever. In that context, now banks are allowed to sale products of two general, two life insurance company and two health insurance companies. Since newer distribution infrastructure would be expensive, the regulator has also looked at utilising existing networks like CSCs. Insurance companies could tie up with CSCs to act as insurance brokers. However, due to the expense management norms, insurers are not finding it cost-effective to partner CSCs. CSCs will offer web-enabled e-governance services in rural areas. They can offer application forms, certificates, and utility payments. With costs under pressure, newer channels like online brokers and web aggregators are also catching up. The Insurance Laws (Amendment) Act 2015 (Amendment Act) omitted §40A of the Insurance Act 1938 and set the backdrop for commission and remuneration limits to be revised. In the interim, Life Insurers were still restricted to the limits specified in the Products Regulations for products being launched or the limits set out in the IRDAI approved File & Use application for existing products and General Insurers are still restricted to the maximum commission amounts notified by the IRDAI through its circulars. A problem that has worsened over the years is that insurers have been focusing on growing sales even if that creates a distortion in pricing for individuals.

LACK OF MANDATE:

Internationally, mandating purchase of insurance covers is common, particularly in areas where an employer needs to be nudged to provide a cover to employees. In China, motor insurance, professional indemnity, health insurance, public liability insurance, work-related injury insurance and environment liability covers are mandatory for segments most exposed to these risks. The UK requires most services to buy professional indemnity and comprehensive general liability, apart from standard motor insurance. The government in India should consider mandating property, catastrophe and certain liability insurances. Making these compulsory will result in prices falling to an extent that these become marginal incremental costs. Even in case of third-party motor insurance which is mandatory, there are about 40% uninsured vehicles on the road. Insurance penetration in India is low, particularly for general insurance, which includes motor, health, property and liability covers. We buy about Rs750 of general insurance per person per year compared to over Rs 6,500 in Russia, China or Brazil, according to a report by the International Monetary Fund (IMF). If we measure premiums as a proportion of GDP, India is at 0.7% as compared to a world average of 2.8%. General insurance is colloquially referred to as non-life, a reflection of its poor-cousin status compared to the larger life insurance sector.

Over the past decade, many new distribution channels have been created—agents, corporate agents, web aggregators, brokers and insurance marketing firms. For a customer, the distinction between these channels is blurred. Both corporate agents and brokers can offer products of multiple insurers. This makes it hard for customers to know whether the distributor is representing their interest or the insurers’. Distribution could be simplified to just two models, agents and brokers. Agents sell one insurer’s products and represent the insurer, whereas brokers, who operate with an open architecture, sell multiple insurers’ products and represent clients. The Indian market has many peculiarities – cultural divide, changing demographics, and geographical complexities apart from a stringent regulatory environment. To survive and more importantly grow in this market, health insurance companies require multiple strategies for distribution. Insurance companies desperately need a new ways to manage its distribution of products, ones that support sales without creating unmanageable rise in distribution costs. Insurance is a multiple transformation industry. Few are looking at being the leading digital insurance company because they are not tied down to a secondary interest – there’s no bank, no agency, For insurers to realise the highest value from distribution, they must define an operating model which supports a multi-product, multi-channel distribution model that compliments an insurer’s revenue objectives and profit margins. Distribution is not only the forefront of the operations but also forms a large proportion of the operating expenses. Insurers can realise the highest value from their agent distribution channel by developing an integrated suite of services oriented to driving sales and reducing servicing costs. With distribution remaining a concern area for private players, IRDA can play an enormous role in bringing the sector back on course by approving innovative formats for distribution. For example, approving the setting up of a dedicated franchisee or a dedicated group to act as business associates who will recruit and manage individual agents for health insurance company that has different parameters for business viability. This will create the right atmosphere for creating cost effective distribution and also individual growth for career agents, who are willing to invest their career with Health Insurance Company. Innovation in this area will require a lot of effort.

Digital disruption in the insurance distribution space is the biggest concern for insurance intermediaries like insurance brokers and insurance marketing firms globally. Globally insurance brokers are concerned about their ability to adapt to the emerging technological changes in the insurance distribution space. Insurance intermediaries believe that the innovative technology trends used in insurance distribution and customization of polices would rapidly change the insurance industry. While the regulator has been giving a gentle nudge to make good use of all existing sales channels, the real challenge is that insurers are seeing a big swing in business from one channel to another. When given an equal opportunity to perform, third party intermediaries are of the view that the true potential of the industry will be unlocked. Bringing in newer touch-points to complement the existing points of sales will only lead to more numbers to the overall business, bringing newer dimensions to India’s insurance growth story. It is difficult to adapt to these changes so quickly. With costs under pressure, newer channels like online brokers and web aggregators are also catching up. As technology innovation, higher customer expectations and disruptive newcomers redefine the marketplace, insurers remain focused on growing top-line sales, bottom-line profitability, addressing challenges, and competing in a dynamic industry. Insurers continue to be challenged by rapidly evolving customer needs and expectations amid heightened competition, many have resorted to belt-tightening and “doing more with less” to shore up returns. However, as the pace of productivity improvements slows with existing staff and systems, many carriers are looking to boost their transformation efforts by integrating more advanced automation, fuelled by software applications that run automated tasks, also known as “bots,” as well as machine-learning algorithms. These options give insurers an opportunity not just to reduce expenses, but also to possibly reinvent how they conduct business.

Channel wise GDPI share of Indian non-life insurance

SELLING INSURANCE TO DOWNTRODDENS:

The evidence from the many recent attempts to sell various kinds of insurance to the poor in India and other less developed countries confirms that these are major concerns for the buyers. They are not insurmountable but demand imaginative solutions. For example, the pensions ought to be indexed — after all, the poor, quite justifiably, do not want to bear the inflation risk, and indeed why would we want them to be the victims of the government’s caprice. Even more importantly, the government must not lose sight of the fact that not everyone in India is in a position to make a living. Go to a village and ask who the poor are and people who are themselves very poor will point to certain households that they help and worry about: Households that live off handouts, households of women and young children quite often, where the man is either disabled, a drunk, dead or just gone. To offer them insurance now or to ask them to contribute to a pension would be a cruel joke. But that does not mean that there is nothing that the State can do to help these ultra-poor. In India, per capita consumption is up by 11%, and food consumption and incomes by more than that. These households are obviously still very poor — indeed unacceptably so — but they are able to join the ranks of the “normal” poor, who are mostly economically self-sustaining. And the fact that the effect is persistent means that the economic return on such investments can be substantial — in India the benefit/cost ratio is projected to be more than 4 to 1.The assumption behind this shift is that people can find ways to sustain themselves as long as they are able-bodied and of working age, but the government needs to help them deal with the stuff that are beyond their control, like old age, disability and death. Families need disability insurance and life insurance because losing the main earning member is one of the easiest ways to fall into desperate poverty.

SALE OF GOVERNMENT SPONSORED PRODUCTS:

Government-sponsored pensions and insurance schemes have of course been there for many years. What is striking is the fact that this government has decided to make them the centerpiece of its anti-poverty efforts, rather than something that gets announced during a budget speech as a sop to a particular constituency and then largely forgotten. There are several issues here. One is the fear that by the time they get the payback inflation would have eaten through it. Another is the not unreasonable suspicion that when it comes to paying out, the person in charge will be incredibly slow and/or demand a bribe. A third is that while death should be easy to establish, disability is not, unless it leaves out everything but the loss of a limb or a sensory organ. Crippling back pain as a result of a workplace injury, for example, is hard to prove, which means whether or not it gets counted will depend on someone’s discretion. Distribution outside large cities is poor. General insurers have about 10,000 branches, of which 57% are in tier I cities with a population of over 100,000. For the private sector, 96% are in these larger cities. Brokers, typically a large distribution channel for general insurance, have 85% of their 385 corporate offices in just seven states, most in the large capitals of Mumbai and Delhi. This means that there are large parts of the country where access to general insurance is limited. The reason insurers and distributors do not build a presence in small towns is that it is unviable. A salesperson in a tier 2 town will have to sell over 10 covers a month to just recover her salary. That’s extremely difficult. In the much better distributed life insurance sector, agents sell just 3-4 insurance covers each month. The solution to this is to allow distributors to earn more when they step outside large cities.

INSURANCE IS A NECESSITY:

Today almost everybody who is starting to earn is taking insurance. There are some possible reasons why people are doing so. One of the most common reasons that people give today is to save tax. Apart from tax saving, the other big reason is of course safety. The main benefit of insurance is to provide support at times of need. Some agents and companies offer insurance policies at their office. But people prefer to take online insurance today. Why is it so? Today everyone has become so busy that no one has that much time to visit different insurance offices to check the policies and then buy a plan. In this case, online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Today people are more into comparing things before buying. Even in a case of insurance policy, people like to compare 2-3 companies before settling on one. Comparing becomes hectic when you are confused in between 2-3 brands. Indian non-life insurers employ a multi-channel approach to market and sell their products, including individual agents, bank partners, other corporate agents, brokers, direct sales and online channels. In FY11-16, proportion of broker and individual agent has been on the rise increasing from 17% & 26.1% to 30.2% & 34.9%, respectively. This shift can be partially attributed to increased usage of online & mobile platform by retail customers. The trend today is toward disintermediation. The Internet has facilitated a certain amount of disintermediation by making it easier for consumers and businesses to contact one another without going through any middlemen.

SELLING INSURANCE TO DOWNTRODDENS:

The evidence from the many recent attempts to sell various kinds of insurance to the poor in India and other less developed countries confirms that these are major concerns for the buyers. They are not insurmountable but demand imaginative solutions. For example, the pensions ought to be indexed — after all, the poor, quite justifiably, do not want to bear the inflation risk, and indeed why would we want them to be the victims of the government’s caprice. Even more importantly, the government must not lose sight of the fact that not everyone in India is in a position to make a living. Go to a village and ask who the poor are and people who are themselves very poor will point to certain households that they help and worry about: Households that live off handouts, households of women and young children quite often, where the man is either disabled, a drunk, dead or just gone. To offer them insurance now or to ask them to contribute to a pension would be a cruel joke. But that does not mean that there is nothing that the State can do to help these ultra-poor. In India, per capita consumption is up by 11%, and food consumption and incomes by more than that. These households are obviously still very poor — indeed unacceptably so — but they are able to join the ranks of the “normal” poor, who are mostly economically self-sustaining. And the fact that the effect is persistent means that the economic return on such investments can be substantial — in India the benefit/cost ratio is projected to be more than 4 to 1.The assumption behind this shift is that people can find ways to sustain themselves as long as they are able-bodied and of working age, but the government needs to help them deal with the stuff that are beyond their control, like old age, disability and death. Families need disability insurance and life insurance because losing the main earning member is one of the easiest ways to fall into desperate poverty.

SALE OF GOVERNMENT SPONSORED PRODUCTS:

Government-sponsored pensions and insurance schemes have of course been there for many years. What is striking is the fact that this government has decided to make them the centerpiece of its anti-poverty efforts, rather than something that gets announced during a budget speech as a sop to a particular constituency and then largely forgotten. There are several issues here. One is the fear that by the time they get the payback inflation would have eaten through it. Another is the not unreasonable suspicion that when it comes to paying out, the person in charge will be incredibly slow and/or demand a bribe. A third is that while death should be easy to establish, disability is not, unless it leaves out everything but the loss of a limb or a sensory organ. Crippling back pain as a result of a workplace injury, for example, is hard to prove, which means whether or not it gets counted will depend on someone’s discretion. Distribution outside large cities is poor. General insurers have about 10,000 branches, of which 57% are in tier I cities with a population of over 100,000. For the private sector, 96% are in these larger cities. Brokers, typically a large distribution channel for general insurance, have 85% of their 385 corporate offices in just seven states, most in the large capitals of Mumbai and Delhi. This means that there are large parts of the country where access to general insurance is limited. The reason insurers and distributors do not build a presence in small towns is that it is unviable. A salesperson in a tier 2 town will have to sell over 10 covers a month to just recover her salary. That’s extremely difficult. In the much better distributed life insurance sector, agents sell just 3-4 insurance covers each month. The solution to this is to allow distributors to earn more when they step outside large cities.

INSURANCE IS A NECESSITY:

Today almost everybody who is starting to earn is taking insurance. There are some possible reasons why people are doing so. One of the most common reasons that people give today is to save tax. Apart from tax saving, the other big reason is of course safety. The main benefit of insurance is to provide support at times of need. Some agents and companies offer insurance policies at their office. But people prefer to take online insurance today. Why is it so? Today everyone has become so busy that no one has that much time to visit different insurance offices to check the policies and then buy a plan. In this case, online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Today people are more into comparing things before buying. Even in a case of insurance policy, people like to compare 2-3 companies before settling on one. Comparing becomes hectic when you are confused in between 2-3 brands. Indian non-life insurers employ a multi-channel approach to market and sell their products, including individual agents, bank partners, other corporate agents, brokers, direct sales and online channels. In FY11-16, proportion of broker and individual agent has been on the rise increasing from 17% & 26.1% to 30.2% & 34.9%, respectively. This shift can be partially attributed to increased usage of online & mobile platform by retail customers. The trend today is toward disintermediation. The Internet has facilitated a certain amount of disintermediation by making it easier for consumers and businesses to contact one another without going through any middlemen.

ONLINE CHANNELS ARE AHEAD OF ALL:

Gone are the days when people just researched about the particular insurance company and then contacted their agents to buy the policy. Now the online payment mode is comfortable and safe and you can buy virtually anything online. This feature has boosted the prospects and scope of online insurance in India significantly. In fact, this is why the popularity of online insurance has enhanced significantly over the years in India. Online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Also, you get an appropriate amount of time to do proper research before buying the policy. Also, the cost of an online policy is less as compared to an offline one since there is no middlemen involved. Online marketing and services are spreading at a lightning speed to almost all the corners of the world. A developing country like India has also been touched by the online services and now almost everything in India is going online. The limit is not only the online shopping and the social networks. Nearly every service from financial to educational and many more are going online so that you do not have to go out anywhere to fetch a particular service. The Internet has also made it easier for buyers to shop for the lowest prices on products. Today, most people buy and renew their policies online without going through any intermediary.

RURAL CHALLENGES:

There is a drastic shift in people wanting insurance. One needs to have insurance as an instrument to maintain the overall financial well being. Although the thumb rule of having a life insurance cover of 10-times your income still exists, in reality it is more complex than that, and is typically tailor made. Once you have defined your goals, your death is a financial loss and, hence, you need to calculate how much those goals cost today (if death were to happen today) plus a certain amount of kitty (for ongoing income), whatever is the corpus is your financial loss. From this amount, once you reduce your existing policy, you arrive at your net loss, which is the amount of insurance you need. More the assets, less the cover. However, if you have more loans and more dependants, and your aspirations are higher, you need more cover. Previously there was only the fear of dying; now there is fear of living, too. People have started thinking in terms of disability, medical as well as pension cover. However, in rural India, there is still a large amount of push needed. Currently, they can get a term assurance plan offered through the Pradhan Mantri Suraksha Bima Yojna (PMSBY), which covers them for Rs 2 lakh at a premium of Rs 330 annually. Hence, there is a start.

ONLINE CHANNELS ARE AHEAD OF ALL:

Gone are the days when people just researched about the particular insurance company and then contacted their agents to buy the policy. Now the online payment mode is comfortable and safe and you can buy virtually anything online. This feature has boosted the prospects and scope of online insurance in India significantly. In fact, this is why the popularity of online insurance has enhanced significantly over the years in India. Online services can be easily accessed from his home or while on transit and at any suitable time, even at midnight. Also, you get an appropriate amount of time to do proper research before buying the policy. Also, the cost of an online policy is less as compared to an offline one since there is no middlemen involved. Online marketing and services are spreading at a lightning speed to almost all the corners of the world. A developing country like India has also been touched by the online services and now almost everything in India is going online. The limit is not only the online shopping and the social networks. Nearly every service from financial to educational and many more are going online so that you do not have to go out anywhere to fetch a particular service. The Internet has also made it easier for buyers to shop for the lowest prices on products. Today, most people buy and renew their policies online without going through any intermediary.

RURAL CHALLENGES:

There is a drastic shift in people wanting insurance. One needs to have insurance as an instrument to maintain the overall financial well being. Although the thumb rule of having a life insurance cover of 10-times your income still exists, in reality it is more complex than that, and is typically tailor made. Once you have defined your goals, your death is a financial loss and, hence, you need to calculate how much those goals cost today (if death were to happen today) plus a certain amount of kitty (for ongoing income), whatever is the corpus is your financial loss. From this amount, once you reduce your existing policy, you arrive at your net loss, which is the amount of insurance you need. More the assets, less the cover. However, if you have more loans and more dependants, and your aspirations are higher, you need more cover. Previously there was only the fear of dying; now there is fear of living, too. People have started thinking in terms of disability, medical as well as pension cover. However, in rural India, there is still a large amount of push needed. Currently, they can get a term assurance plan offered through the Pradhan Mantri Suraksha Bima Yojna (PMSBY), which covers them for Rs 2 lakh at a premium of Rs 330 annually. Hence, there is a start.

PRODUCT INNOVATION:

Introducing a completely revamped product portfolio is a big effort. Introducing new products, training the sales force and getting the momentum back in sales are all big challenges. Product innovation is happening and owing to the Insurance and Regulatory Development Authority (IRDA) regulations, traditional products are also becoming very transparent for the insured, specifying the minimum payout that has to be made to policy holders as well. It is only a matter of time before insurance picks up, considering we are seeing the economy showing an upward trend. Purchasing power is increasing; however, the share of insurance to GDP has not increased in that proportion. A large number of product variants are available and we would also like more in the health care sector. Apart from illnesses, we have people living much longer who require cover where treatments are taken at home, long-term care products, wherein you pay your premium during your work life and get the benefits on retirement, including nursing treatment, etc. If somebody is willing to pay more premiums, treatment across the globe should also be available. India is under insured due to a variety of factors, including how much people are willing to invest in insurance and, the fact that, products used to be complicated. Things have changed. You can now buy insurance with ease and more products are available at cheaper costs. In the UK, there is basic stakeholder insurance for the masses; we have the Government of Indian doing it.

MIS-SELLING ALSO PREVAILS:

Even though banks may have taken necessary action against erring employees and also refunded the premium to customers, these steps are not enough, the circular stated. The regulator wants banks and NBFCs to have a system that proactively detects and discourages such kinds of mis-selling. It has also asked insurers to comply with rules and disclose details of Specified Persons (SP). These are individuals responsible for selling insurance plans in banks. Giving out details will help ascertain which SP was responsible for mis-selling. Banks act as corporate agents through bancassurance agreements with insurance companies. Currently, over 400 corporate agents have registered with IRDAI to sell insurance products. The most commonly used method is to bundle an insurance policy with a loan. The policy is sold as a compulsory requirement to taking a loan and is bundled despite express unwillingness of customers. You should know that buying insurance is not mandatory when taking a loan, but it is advisable to buy a term insurance policy to cover big ticket loans such as a home loan. What you also need to be wary of is that banks may want to sell you a single premium policy and bundle the premium in the loan amount. This increases your equated monthly instalment (EMI) since it also includes the premium. Don’t bundle the premium with the loan. Buy a regular premium policy instead.

Banks also make purchase of insurance a mandatory prerequisite to opening a bank locker. Again, this is not as per regulations. Banks could even insist on an insurance-cum-investment plan, which is irrelevant to opening a locker. The single-premium policies were issued in place of fixed deposits stating better benefits. A fixed deposit is a pure investment product with a guaranteed rate of return, whereas an insurance savings plan is a bundled product which may or may not guarantee the return. Further, insurance plans come with high surrender costs. Fixed deposits and insurance are not substitutable. Buy a product with a goal in mind and one that meets that goal most efficiently. The regulator also received complaints about policies being sold without customers’ consent or signatures, and with incorrect contact details. There have also been instances of banks selling regular premium policies in place of single-premium policies and debiting renewal premiums from customer’s bank account without any intimation. This is a clear case of misconduct and if you have been a victim to such malpractice you can take it up using the Integrated Grievance Management System, and ultimately the insurance ombudsman.

PRODUCT INNOVATION:

Introducing a completely revamped product portfolio is a big effort. Introducing new products, training the sales force and getting the momentum back in sales are all big challenges. Product innovation is happening and owing to the Insurance and Regulatory Development Authority (IRDA) regulations, traditional products are also becoming very transparent for the insured, specifying the minimum payout that has to be made to policy holders as well. It is only a matter of time before insurance picks up, considering we are seeing the economy showing an upward trend. Purchasing power is increasing; however, the share of insurance to GDP has not increased in that proportion. A large number of product variants are available and we would also like more in the health care sector. Apart from illnesses, we have people living much longer who require cover where treatments are taken at home, long-term care products, wherein you pay your premium during your work life and get the benefits on retirement, including nursing treatment, etc. If somebody is willing to pay more premiums, treatment across the globe should also be available. India is under insured due to a variety of factors, including how much people are willing to invest in insurance and, the fact that, products used to be complicated. Things have changed. You can now buy insurance with ease and more products are available at cheaper costs. In the UK, there is basic stakeholder insurance for the masses; we have the Government of Indian doing it.

MIS-SELLING ALSO PREVAILS:

Even though banks may have taken necessary action against erring employees and also refunded the premium to customers, these steps are not enough, the circular stated. The regulator wants banks and NBFCs to have a system that proactively detects and discourages such kinds of mis-selling. It has also asked insurers to comply with rules and disclose details of Specified Persons (SP). These are individuals responsible for selling insurance plans in banks. Giving out details will help ascertain which SP was responsible for mis-selling. Banks act as corporate agents through bancassurance agreements with insurance companies. Currently, over 400 corporate agents have registered with IRDAI to sell insurance products. The most commonly used method is to bundle an insurance policy with a loan. The policy is sold as a compulsory requirement to taking a loan and is bundled despite express unwillingness of customers. You should know that buying insurance is not mandatory when taking a loan, but it is advisable to buy a term insurance policy to cover big ticket loans such as a home loan. What you also need to be wary of is that banks may want to sell you a single premium policy and bundle the premium in the loan amount. This increases your equated monthly instalment (EMI) since it also includes the premium. Don’t bundle the premium with the loan. Buy a regular premium policy instead.

Banks also make purchase of insurance a mandatory prerequisite to opening a bank locker. Again, this is not as per regulations. Banks could even insist on an insurance-cum-investment plan, which is irrelevant to opening a locker. The single-premium policies were issued in place of fixed deposits stating better benefits. A fixed deposit is a pure investment product with a guaranteed rate of return, whereas an insurance savings plan is a bundled product which may or may not guarantee the return. Further, insurance plans come with high surrender costs. Fixed deposits and insurance are not substitutable. Buy a product with a goal in mind and one that meets that goal most efficiently. The regulator also received complaints about policies being sold without customers’ consent or signatures, and with incorrect contact details. There have also been instances of banks selling regular premium policies in place of single-premium policies and debiting renewal premiums from customer’s bank account without any intimation. This is a clear case of misconduct and if you have been a victim to such malpractice you can take it up using the Integrated Grievance Management System, and ultimately the insurance ombudsman.

“POSP” TO GAIN MOMENTUM:

As per the IRDAI guidelines, life insurers can sell pure term insurance products, immediate annuity products and non-linked non-participating endowment products through the POSPs. In the general insurance sector, IRDAI has said that POSPs can sell policies such third party motor insurance, personal accident policy, cattle insurance, home insurance policy as well as travel insurance policy. The regulator has clarified that POS products would have to be plain vanilla products that are easy to understand and simple to sell. The general insurance industry will now look at selling motor insurance policies through the POSP, if we have adequate numbers. Apart from the regular policies, IRDAI has allowed POSPs to sell crop insurance (government insurance schemes such as Pradhan Mantri Fasal Bima Yojana), Weather Based Crop Insurance Scheme (WBCIS) and Pradhan Mantri Jeevan Suraksha Bima Yojana. Companies are now involved in designing and filing products for this distribution channel. Insurers have also been asked to file half-yearly returns for the POS products. IRDAI has defined the features of the products and the sum assured allowed under the schemes. For instance, the regulator has said that in case of a pure term product, the maximum sum assured that permissible to be sold be POSPs would be Rs 25 lakh. Further, the insurers will not be allowed to provide a return of premium feature for them. Insurance companies have started designing specialised policies to be sold by Point of Sales Persons (POSPs).

NEWER DISTRIBUTION CHANNELS: